It was by teaching a course on energy in 2004 that I first became aware of the enormous challenges facing our society this century. In preparing for the course, I was initially convinced that I would identify a sensible and obvious path forward involving energy from solar, wind, nuclear, geothermal, tides, waves, ocean currents, etc. Instead, I came out dismayed by the hardships or inadequacies on all fronts. The prospect of a global peak in oil production placed a timescale on the problem that was uncomfortably short. It took several exposures to peak oil for me to grasp the full potential of the phenomenon to transform our civilization, but eventually I was swayed by physical and quantitative arguments that I could not blithely wave off the problem—despite a somewhat unsettling fringe flavor to the story.

It was by teaching a course on energy in 2004 that I first became aware of the enormous challenges facing our society this century. In preparing for the course, I was initially convinced that I would identify a sensible and obvious path forward involving energy from solar, wind, nuclear, geothermal, tides, waves, ocean currents, etc. Instead, I came out dismayed by the hardships or inadequacies on all fronts. The prospect of a global peak in oil production placed a timescale on the problem that was uncomfortably short. It took several exposures to peak oil for me to grasp the full potential of the phenomenon to transform our civilization, but eventually I was swayed by physical and quantitative arguments that I could not blithely wave off the problem—despite a somewhat unsettling fringe flavor to the story.

Aside from excursions here and there, Do the Math represents—in computer terms—a “core dump” of years of accumulated thoughts and analysis on energy, growth, and the largely unappreciated challenges we face on both short and long terms. During this queued process—with much more to come—I have made references to peak oil, but have refrained from a head-on treatment. As important as peak oil has been in motivating my quantitative exploration of life beyond fossil fuels, it seems overdue that I share my thoughts.

Calling the Bubble

Before I dive into oil—no, not literally—I’ll share a story that has some resonant parallels. When my wife and I moved to San Diego in 2003, we understood that if we wanted to buy a house, we should do so without delay—as prices were climbing fast. Spending a year optimizing a search for the perfect house risked pricing us out of the market. Interest rates were at historic lows, meaning that prices were soaring while keeping the monthly payment—the key determinant of house affordability—roughly constant. We bought a house practically overnight in the summer of 2003. In 2005, I became nervous about the spectre of rising interest rates and the effect this would have on prices. Since we were not yet firmly tied to San Diego, we wanted to keep options open for moving elsewhere. I worried that a fall in house prices—for any reason—could trap us underwater in debt.

I sought articles and analysis on projected house prices, and came across two divergent predictions: level/growth (most stories); and bursting bubble. I noticed a clear difference in the flavor of the articles. The bursting bubble stories used lots of numbers, stats, and analysis. I’m a sucker for that. Specifically, the fact that 60% of new home loans in Southern California were interest-only or otherwise sub-prime worried me a lot, as did the statistic that only 9% of families in San Diego could afford the median-priced home. Unsustainable, I thought.

Meanwhile, the level/growth narratives tended to be hand-wavy: San Diego was such a desirable place to live that homes would not lose their value. The expanding diversity of jobs into high-tech further insulated San Diego against downturn. The activity was not speculative because families—not investors—were actually buying and moving into homes at the elevated prices. We had reached a new normal in prosperity.

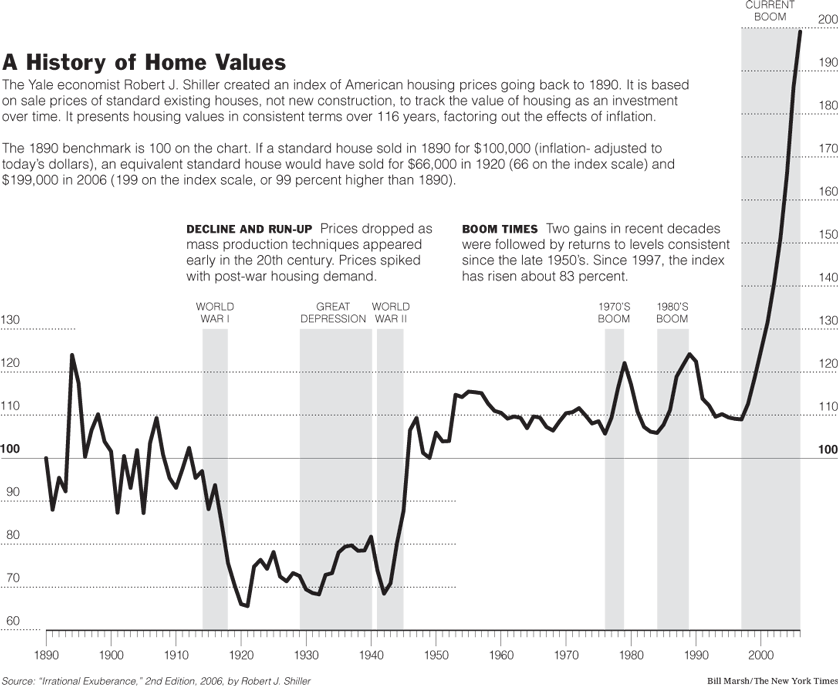

Take a look at the home price index published in the New York Times in 2006. There were boom/bust cycles in the 70’s and 80’s, but the tidal wave starting in 2000 is wholly unlike anything that came before: a factor-of-two price adjustment in a few years.

Can you believe that rational people were claiming we had hit a new normal? That this fantastic rise would not come down? I certainly couldn’t swallow it. My wife and I decided to sell in mid-2005, and managed to break free in early 2006, at the height of the market in San Diego. Quantitative analysis was on our side.

An Even Stronger Case

A plot of fossil fuel consumption over the long term looks somewhat like the right-hand-side of the house price figure above—in that it has rocketed up in near-exponential fashion over the last couple of centuries. So what? Fossil fuel production has little in common with real estate prices, so the fact that the housing bubble crashed holds no predictive power for fossil fuels. But in this case, the quantitative evaluation of where fossil fuels will go is even more convincing than market predictions for housing. In the fossil fuel case, it comes down to physics, and I’m on my home turf. I am far more confident that finite fossil fuels will peak and decline than I was about the housing market in San Diego prior to the crash. And it should tell you something that I was confident enough in that to sell my house and move into a rental, at significant personal inconvenience.

Despite the certainty of its occurrence, peak oil is such a complex, multi-faceted problem that any one argument is insufficient to seal its fate as either a major turning point in human history or a footnote of history to be smoothly traversed. It is in the balance of ideas that I land on the “major event” side of the spectrum. Establishing any position—regardless of where on the spectrum—inevitably involves some subjectivity. But similar to the housing market assessments of 2005, I find an asymmetry on the quantitative side of the story that ultimately is too compelling for me to ignore. Here, I will walk through some of the issues I have had to sort out in order to establish what I think is likely to be true.

Keep in mind that I am not making predictions here or demanding that readers are persuaded by the same arguments/analysis that I have found compelling. I’m just laying out a set of reasons why I think the phenomenon deserves our directed attention. I should also clarify that while I speak of “peak oil,” my main concern is the decline that follows a peak (or plateau). The peak itself is nothing but fun!

Getting Calibrated

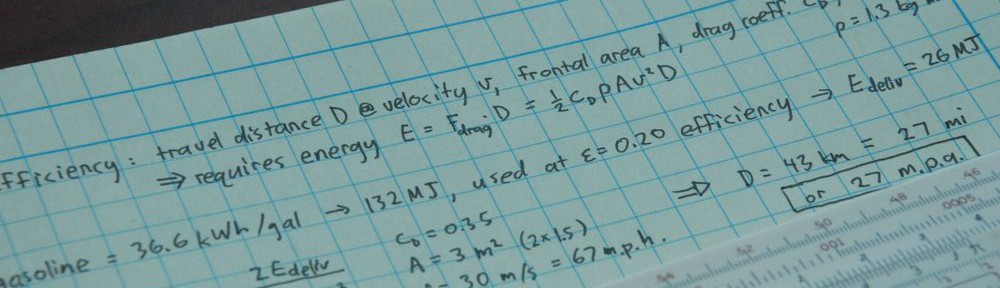

Any discussion of oil production is much easier if you enter knowing a few basic numbers. The world uses about 86 million barrels per day (Mbpd) of petroleum in its various forms, about 20 Mbpd of which is consumed in the U.S. This comes to 31 billion barrels (Gbbl) per year globally, and a little over 7 Gbbl for the U.S. Conventional crude oil makes up about 73 Mbpd of the 86 total, the rest coming primarily from natural gas plant liquids (NGPL), and some from tar sands and other alternatives.

Sub-subsistence Living

Imagine that your lifestyle demands $30,000 per year for rent, food, travel, entertainment, clothing, etc. in order to “subsist.” Now what if I tell you that your earnings potential amounts to only $10,000 per year, and is almost certain to only go down from here. I expect you should feel distressed. But because you once pulled in a salary of $60,000 and were frugal at the time, you have a bit of a cushion in savings. Still, the current situation and dimming prospects should raise serious concern. This is similar to the case with oil discoveries, or “income.” Just replace “dollars” with “million barrels of oil” and we have our analogy.

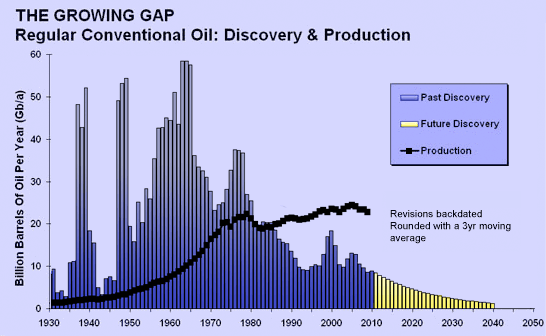

Global oil discoveries peaked in the 1960’s, when every year we found far more oil than we consumed. How could one not be optimistic about our future during this era? Starting in the early 1980’s, we crossed the line to finding less new oil each year than we used, and we have never gone back. This causes no immediate problem, since we still have a backlog of discovery to exploit. Nonetheless, the trend is telling, and the obvious statement that a past peak in oil discovery must one day result in peak production is inescapable.

What amazes me is that each time we discover a few-billion barrel deposit in the world, the trumpets come out and the headlines gush with the news. But these just add up to something like 10 billion barrels a year: far short of yearly production. We expect to continue discovering something like 10 billion barrels per year in the near term. The headlines we don’t see are more important:

Yet another year of lackluster oil discovery, far short of break-even.

Why aren’t we hammered with this headline year after year? Instead, it’s always champagne and caviar over the buckets we do manage to find.

Rational people agree on the peaking of conventional oil. The fights are over timing. Most estimates fall between 2005–2020, although a minority of vested voices (with poor predictive track records) speak of a plateau lasting for decades. I will note that we lately appear to be on a plateau that began around 2004.

Peaks Happen

It is well known that individual oil fields universally see a production peak—often early in their production lifetimes—followed by persistent decline. The geological upshot is that oil is not a lake into which we thrust a straw, slurping as fast as we wish. Rather, oil is a viscous fluid in porous, permeable rock that resists rapid recovery. It’s not a spigot or valve that we can turn at will. Nature has a say in how fast we can claim the oil. When economists speak of reserves-to-production (R/P) ratios to set a time scale on oil depletion (usually a few decades), this “lake” is the implied model. The R/P ratio is a useful number, but its use obscures geological limitations to the rate of recovery. In truth, oil will last longer than the R/P indicates, but at a reduced rate of flow. The decline, meanwhile, is closer at hand than the R/P number alone conveys.

The lesson is that we don’t have full control over oil production. If previous discoveries are in decline, and we are not adding new fields at a replacement rate, we should expect aggregate decline. This is why well over half the major oil-producing countries have passed their peak performance (see the Hirsch Report Summary—reporting 33 of 48 in decline, and a 2008 analysis showing similar asymmetry). It is thought that Saudi Arabia is the only country left with any spare production capacity—effectively like a spigot that can be opened wider on demand. Even this is a debatable point, and at most amounts to something like one Mbpd (out of 86 globally).

If It Can Happen Here…

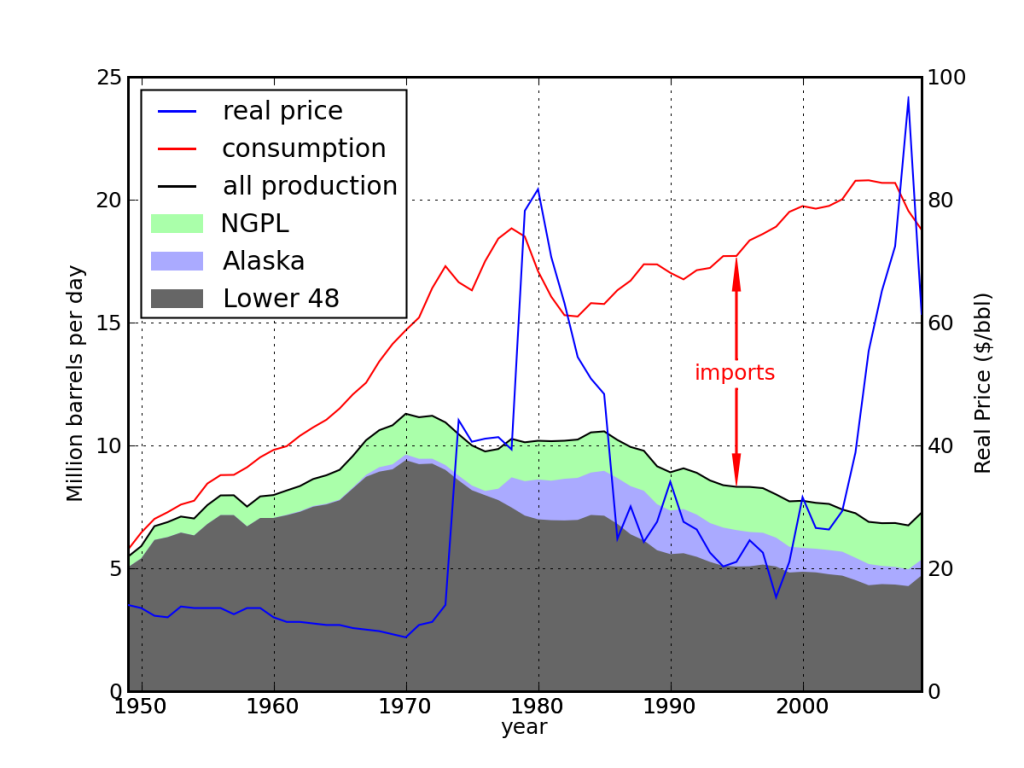

Indeed, it was clear (to some, like Hubbert) as early as the 1950’s that the peak of oil discoveries in the U.S. in the 1930’s portended a peak of domestic oil production around 1970. Since 1970, the U.S. has seen overall decline in oil production, now about half what it once was. Demand has continued to rise, so that we have shifted to an oil supply dominated by imports.

We see above (source: EIA) that oil from Alaska helped stave off a monotonic decline, but that it could not recapture the past glory of the peak. Alaskan oil has diminished now to the point that the pipeline will soon have to be shut off completely, otherwise the rate would become too slow to prevent freezing and seizing up.

Note that the U.S. decline happened not for lack of stability (wars on our turf), lack of technology, lack of management acumen, or lack of political will to be more self-sufficient in energy. The decline happened because geology is in the driver’s seat. Dramatic price shocks in 1973 and 1979—amounting to a factor of 8 price increase—were insufficient to drive production beyond the 1970 peak. The shocks played a role in stimulating the Alaskan oil flow, which indeed arrested the decline for a time. Yet the overall story is one of increasing demand atop declining production.

Straining at the Plateau

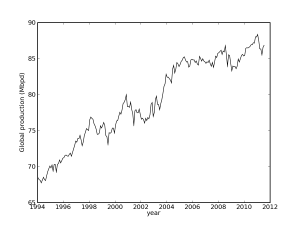

Since about 2004—well before the economic disasters of late 2008—global oil production hit something of a plateau, oscillating within ±3% of 86 Mbpd (source: EIA).

During this time, prices steadily climbed, signaling increasing demand. A common argument is that oil reserves—in contrast to resources—are a function of price. A greater fraction of the total resource is economically viable at a higher price. This is used to advocate the view that we can maintain a plateau indefinitely (or even climb higher). The basic mechanism does function, but is it sufficient?

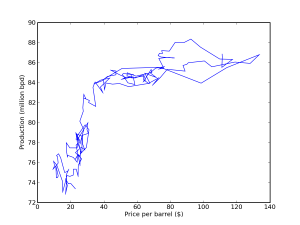

Above is a plot of oil production as a function of price from 1997 to 2011, inspired by Gail Tverberg (data source: EIA). On the left-hand side, we see a familiar correlation of price and production: if spare capacity exists, higher prices stimulate increased production. But something dramatic happens at about 84 Mbpd. Increasing the price by a factor of three is insufficient to budge production by more than a few percent. There appears to remain a slight positive slope (economics still works in the normal sense), but the thing is incredibly inelastic. I interpret this as empirical evidence that we are straining the limits of production capacity. Where was the relief valve?

As an aside, a compelling story about the financial collapse of 2008 puts this production limit at center stage. As supply failed to meet demand and prices rose (amplified by speculation, yes), the transportation, airline, tourism, automotive, and other directly related industries began to suffer and fold under pressure. The resulting economic slowdown deprived the sub-prime racket of oxygen, forcing the house of cards to collapse on itself. The racket worked as long as growth continued and housing prices did not falter. So we may have seen our first peak-oil economic disruption. The sub-prime tinder-box added to the pop. A recent article in Mother Jones touches on this interplay.

Logistically Speaking

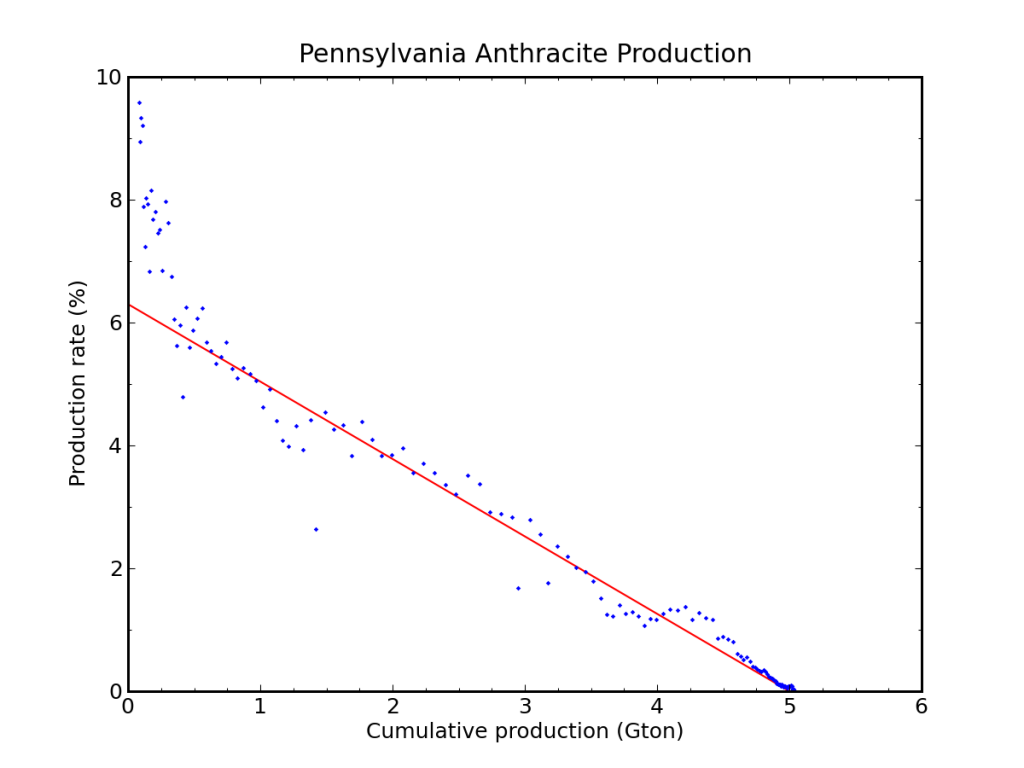

I am additionally swayed by the frequent success of logistic functions to predict total amount of resource well before it is exhausted. This does not always work (i.e., don’t pepper me with exceptions, of which there are plenty). But the fact that it has worked so well for major resources in the past is interesting and compelling.

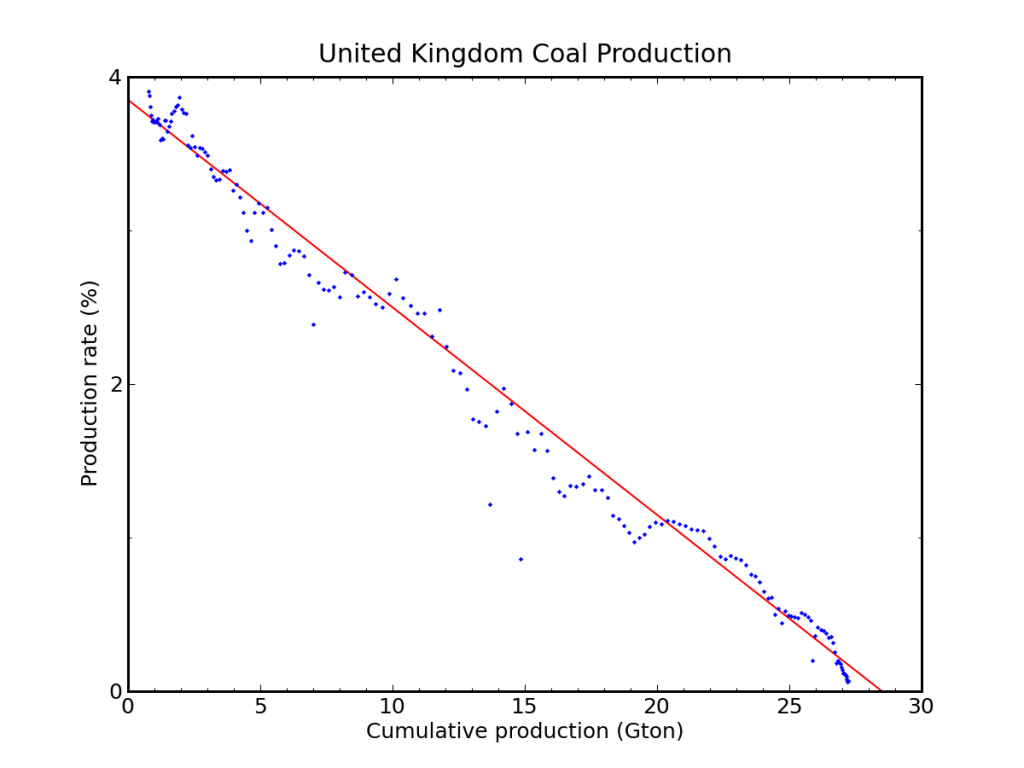

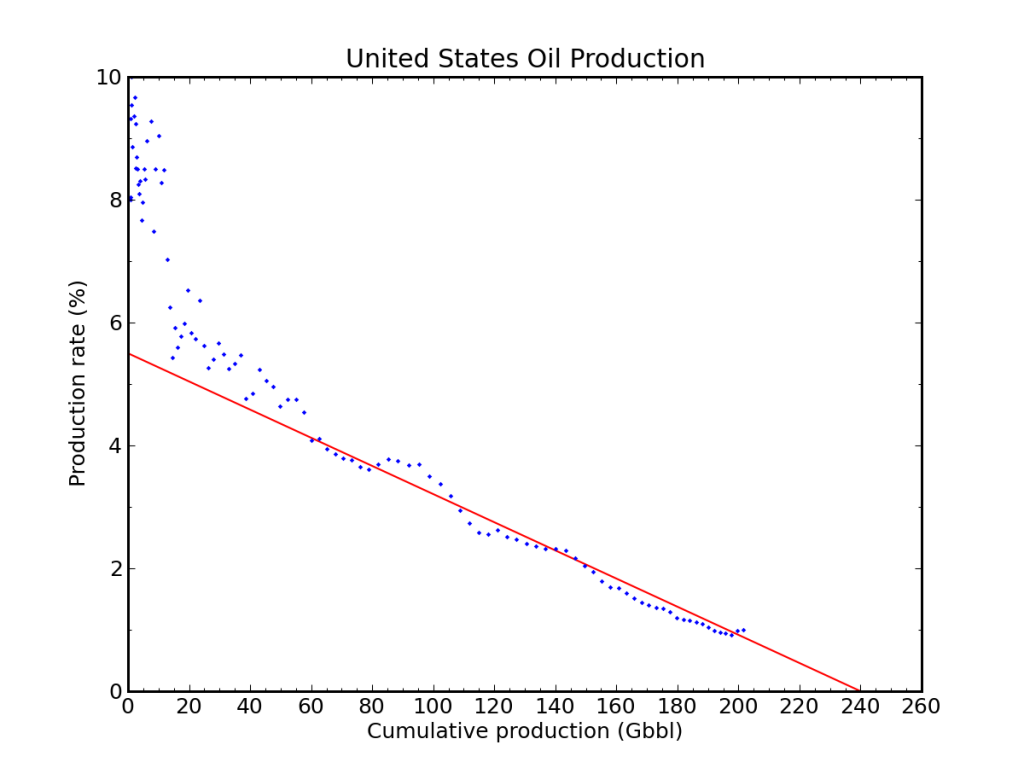

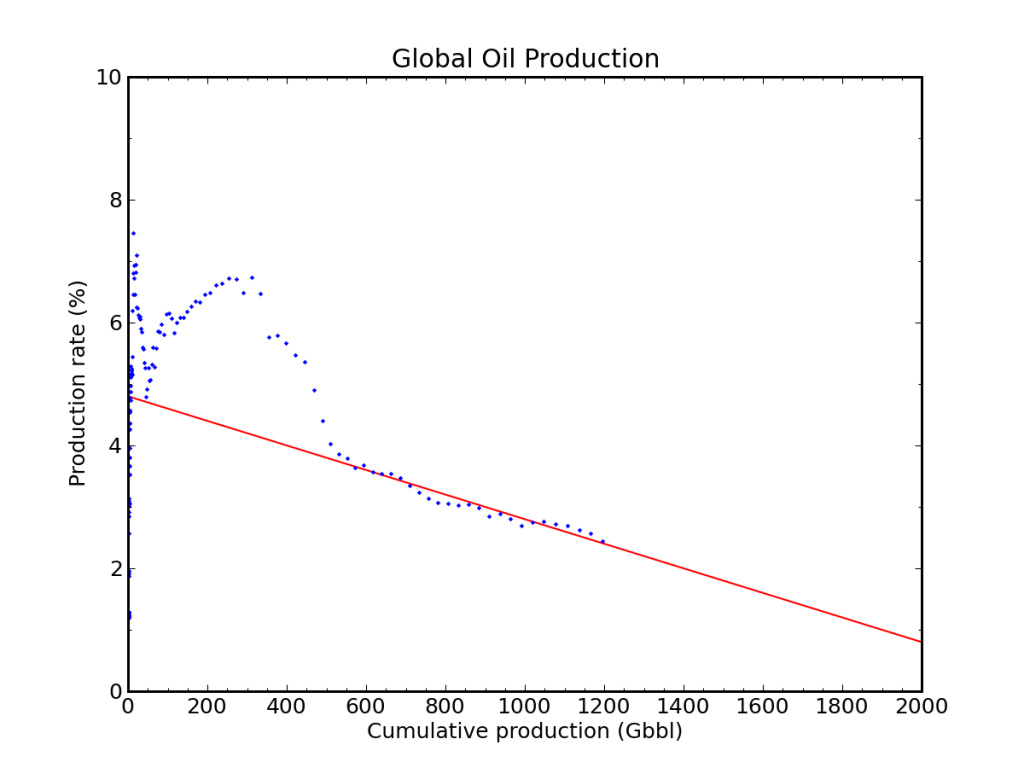

If for each year, we plot the amount of resource produced in that year as a fraction of the total resource extracted to date against the total extracted resource, a logistic function makes a straight, descending line intercepting the horizontal axis at the value of the ultimate resource. The peak production rate occurs at the half-way point along the trend. By contrast, constant-growth exponentials (infinite resource) follow a flat line: same fractional production every year. Below are four such examples for prized Pennsylvania anthracite coal, British coal, U.S. oil (including Alaska), and global oil.

The two coal cases are amazing to me: whole development histories follow the logistic curve strikingly well. No one commanded them to do so. Well before the resource was fully exhausted, it would have been possible to draw a line and predict the amount of ultimately recoverable resource with some accuracy.

For U.S. oil, we are far enough along to estimate that the total recoverable resource is in the neighborhood of 240 billion barrels. According to this, we have about 40 billion barrels yet to produce. For comparison, the proven reserves in the U.S. currently total 21 billion barrels, so the logistic plot suggests we have about the same amount yet to find (or to become economically viable). For scale, the (discovered) resource in the Arctic National Wildlife Refuge (ANWR) is approximately 10 billion barrels. The 40 billion barrel estimate is in no way set in stone, but a conservative approach suggests it would not be prudent to count on there being more—at least not at historically “reasonable” prices.

For global oil resources (all liquids), we have consumed 1.2 trillion barrels so far. The data did not follow a logistic path in its early years, but has done so for the past three decades. If this portion is predictive, it says that our total resource is about 2.4 trillion barrels, putting us half-way along (therefore around the peak of the logistic rate). This by itself is a weak prediction. But the discovery rate we have seen (peaking in the 1960’s) does not lay the groundwork for us to expect a radical departure from the logistic line any time soon.

Possible Reaction to Oil Decline

It is rather clear that conventional oil is fated to peak (or plateau) and decline. The worry, then, is that economies are forced into ramping-down use of liquid fuels while oil prices skyrocket. Recession ensues; demand flags; prices return to almost normal; rinse and repeat. If you’ve ever watched a hummingbird (or some large insects) trapped inside, they repeatedly crash into the ceiling. Economic attempts to resume growth likewise will soon rediscover the ever-declining oil supply ceiling. Like the confused bird who does not notice the open window, those who would establish expensive new ventures for alternatives will be hampered by market volatility and uncertainty—worried about going bust in the next half-cycle.

Global recognition that failing oil supply is the problem and that we are at the start of an inexorable oil decline may result in loss of confidence in long-term investment gain, so that many withdraw from the market—fleeing to gold or cash or other escapes deemed safe against year-over-year declines. Foreign investors could pull out of U.S. holdings, lacking confidence in our ability to grow against a backdrop of oil decline. The dollar could be abandoned as the standard currency for oil exchanges. A long-term global crisis of confidence could dramatically change the rules of the game.

About ninety percent of the oil in this world is controlled by national oil companies: not multi-nationals like ExxonMobil, etc. If even one major oil-exporting country decides to reduce exports, recognizing that they should preserve a valuable and waning resource for their own future, the decline gets that much worse—sending prices higher and tempting more countries to do the same. If export prices double, a nation figures, it can sell half as much and still keep its economy on an even keel. Nations that do not regard oil as a fundamentally special commodity—a one-time physical endowment not easily replaced with money—may elect to cash in on the bonanza, keeping their export level at maximum capacity (where virtually all operate today). But I doubt that this short-sighted reaction will be universal.

The potential exists, therefore, for major disruption to our accustomed ways of life. We will become viscerally aware of how fundamentally important oil is to all that we do. Even though energy may represent something like 10% of GDP, it’s what makes the other 90% possible. It’s not just another commodity like sneakers or widgets. Curtail transportation and watch the grocery store shelves struggle to stay full. See food prices escalate and cause immediate hardships around the world. Find out how far-flung about the globe the material resources are that comprise a cell phone.

I am not claiming any crystal ball clarity in imagining these scenarios, but I do believe they represent distinct possibilities. Only by acknowledging the potential for such developments would we intentionally safeguard ourselves against them, to the degree possible.

Plenty of Hydrocarbons

A decline in conventional oil production represents a liquid fuels problem. Crash programs in solar, wind, or nuclear infrastructure—besides suffering from the Energy Trap phenomenon—do not address the fundamental problem. Replacing a fleet of vehicles with electric cars or plug-in hybrids will take decades to accomplish, amidst decline and hardship. Biofuels that can scale to meet the demand gap and that do not compete directly with food supply have not been demonstrated. But wait! There are loads more hydrocarbons in the ground besides conventional oil.

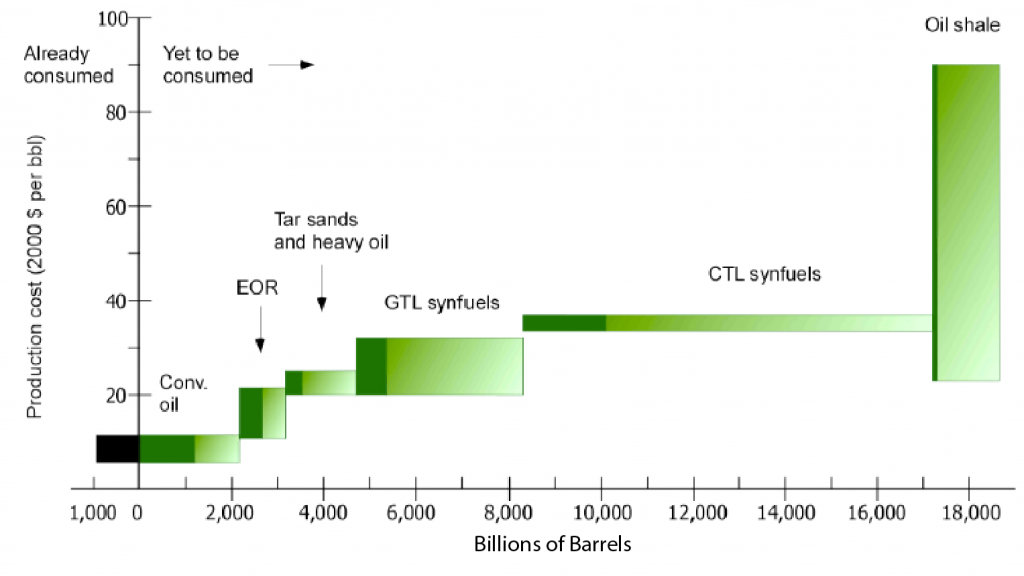

This graphic, adapted from Brandt & Farrell, shows the estimated resources of all hydrocarbons, together with their production cost. Proven reserves are the dark bands to the left of each block, and increasingly uncertain potential resources stretch off to the right for each component. The graphic conveys that in order of increasing cost, enhanced oil recovery, tar sands and heavy oil, gas-to-liquids, coal-to-liquids, and oil shale add substantial stocks at production costs that are only 2–10 times that of conventional oil. Those who are primarily interested in climate change are not too happy with the implications, but this situation could alleviate concerns over oil decline.

I should point out that the production costs of the various hydrocarbons in the plot above are based on 2007 energy prices. Using the escalated energy prices brought on by a conventional oil decline pushes everything higher on the scale. So don’t take either axis of the graph literally.

I will admit that personally, this is the strongest evidence I have seen for why I should not worry about peak oil. I will completely understand if we part company here, and you conclude that post-peak conventional oil decline does not pose a significant threat to our way of life. At least I know that you are aware of the potential dangers, and that if things do go off the rails, peak oil will be in your vocabulary. I’m not interested in being right as much as I am interested in awareness so we can anticipate troubles and get busy with earnest mitigation/prevention. I just don’t want to get caught with our collective (size 40,000 km) pants down, and have to listen to “no one could have seen this coming” excuses like we did with the crash of the sub-prime housing bubble.

So how can I look at the total hydrocarbons figure and still have concerns? Most simply, peak oil is about rates, not amounts. It’s also about economics, the speed with which we could scale, energy returned on energy invested (EROEI), carbon caps, and other practical matters. The fact that oil prices recently rose by a factor of three while no relief arrived from other hydrocarbons can be taken as empirical evidence that the vast amount of hydrocarbons in the ground is not immediately useful in a pinch. The market did not cradle us and take care of business, as the perennial promise goes.

Also worth pointing out is that when U.S. oil production peaked in 1970 at 3.5 billion barrels per year, we had about 40 billion barrels in proven reserves and at least 60 billion barrels of additional resource yet to be discovered. Neither the amount in the ground, nor the will to increase production held sway over the actual rate of extraction.

A 2005 report commissioned by the U.S. Department of Energy (called the Hirsch report: summary and full text) performed a detailed analysis of which technologies and strategies are in a ready-to-go state for scaling up crash programs to mitigate conventional oil decline. The conclusion can practically be read right off the graph above. Besides increased vehicular efficiency, the mitigation schemes involved enhanced oil recovery, tar sands, gas-to-liquids, and coal-to-liquids. Note the fossil fuel theme: we’re hooked!

The bottom line was that initiating all such crash programs in parallel 20 years ahead of the peak (or more to the point, 20 years before the start of decline) may be sufficient to avoid major hardships. Waiting until 10 years before the decline would result in major disruptions as the efforts struggled to establish a large enough foothold in time for the decline. Initiating the crash program at the moment the decline starts was characterized as having catastrophic repercussions. Not treated was the more politically realistic scenario of waiting until 5 years after the start of decline while we bicker about the fundamental cause of our woes and strategies for mitigation.

Why am I prone to heed the conclusions of this report? In large part, it is because of the scale of the problem. A 3% per year decline of conventional oil (considered mild in many models/scenarios), requires that we replace 2.5 Mbpd of capacity each year. Canadian tar sands, for instance, were at 1.2 Mbpd in 2008, and are projected to reach 3–4 Mbpd by 2020. This represents an impressive growth rate of 10% per year. But a 3% decline beginning in 2015 will need five times the marginal oil represented by the gain in this expanding front-runner. Other methods are less ready to scale than tar sands. In the U.S. alone, a 3% decline represents about 42 GW of yearly power loss, requiring the equivalent of about one nuclear plant per week in gas-to-liquid plants, coal-to-liquid plants, and other major infrastructure investment. Not to mention that coal mining and gas production must scale up for the challenge (can they?). When have you heard of workers moving to coal country for employment?

Because we will more likely wait until the pain of decline has made itself clear, we may find ourselves handicapped by recession and debt, hampering our ability to act boldly.

Quick Wrap-Up

This post has swelled to larger dimensions than is ideal. I have covered the main points, and may circle back for another pass at a later date. For now, I will end with a by-now-familiar plea that we not wave off potentially debilitating threats to the stability of our civilization. The risk is asymmetric: starting a crash program toward replacement of finite fossil fuels too early has great up-sides and marginal downsides (opportunity cost); but failure to act has enormous downside for marginal upside.

We tend to have self-confidence in our ability to solve any problem. But we have no historical analog to the peak of fossil fuels, without a clear (and superior) replacement on the horizon. As a result of our fossil fuel binge, we have unprecedented problems in population, water, agriculture, fisheries, pollution, climate change, and so on. Our moment in history is rather special. It is dangerous to assume that we’ll gracefully handle problems at this scale, because such assumptions amount to dismissals and concomitant inaction. Unacceptable.

It bothers me that we don’t have a plan. It scares me that we (collectively) don’t think we even need a plan. Faith in the market to solve the problem represents a high-stakes gamble. We can and should do better.

The frustrating thing for me is that I believe it is possible to beat this problem, but only if we aggressively alter our practices. We would never adopt the necessary radical changes without first agreeing on the potential for disaster otherwise. Yet even if I’m wrong about the problem, the shift I imagine may result in a better, more fulfilling life anyway. I’ll have to describe this vision of a possible future at a later date.

Views: 21536

I personally have done something akin to that. But rather than invest in gold or cash, I paid off my mortgage and put a PV + SHW array on my roof sufficient for all my household electricity needs and most, if not all, of what an electric vehicle would consume.

As a purely financial investment, it can’t be beat. It’ll pay itself off in several years (assuming unrealistically modest inflation for electricity rates), which works out to about a 10% annual rate of return. You can’t get that kind of ROI anywhere in the financial markets these days. And, if energy costs skyrocket, my effective rate of return skyrockets accordingly.

If more people would consider personal renewable energy production facilities as a financial investment and do as I’ve done, I think it would significantly help ease the pain of peak oil.

Cheers,

b&

“If more people would consider personal renewable energy production facilities as a financial investment”

The best investment is in building efficiency. Smallscale renewable energy production is often not a good investment. Small scale wind rarely makes sense at all. Small scale PV maybe but only after everything has been done to reduce energy waste. Solar hot water on the other hand is relatively unexpensive and efficient where solar exposure is sufficient. It should be much more widespread in the US but isn’t because – guess what – lack of economic incentives.

One should use a healthy portion of skepticism when it comes to statements of the kind: “Small scale energy production does not make sense.”

This might be true for wind turbines (maybe an interesting topic to investigate in a future article here).

But if I was a big utility company I would surely be scared of small scale energy production, i.e., people growing less dependent on my essential (local) monopoly. Sure I had the money and means to promote voices advocating the view that small scale energy production does not make sense.

I think energy efficiency is a good first step to take when considering renewable energy. It makes the system you need smaller and less expensive.

Utility companies actually benefit in some way. Sure, they lose revenue from reduced demand. But, it’s less load on their system, particularly during storms, heat waves, and space weather events (geomagnetic storms). Those are expensive to deal with, as is the infrastructure to prepare for them. At least it’s a selling point for them to be friendly towards home renewable energy.

“Small scale energy production does not make sense.”

No I wouldn’t say that. There are situations where it has its place but small-scale isn’t the panacea that some think it is. Let’s not delude ourselves. Wind turbine efficiency depends on the square of the diameter and the third power of wind speed. Small units in urban settings will even under optimistic assumptions realize only a fraction of their nominal capacity. There is no way they are a good investment.

“people growing less dependent on my essential (local) monopoly”

The obvious way to be less dependent on energy utilities is to use less energy. After that – when you have done all you can do to reduce waste and optimize your energy budget – you can start putting PV panels on the roof. Not the other way round.

Utilities welcome small scale installations.. even if they quietly scoff at them.

I was speaking with the VP in charge of sourcing electricity about whether NVEnergy would oppose municipal P.A.C.E Funding campaigns in Northern Nevada (pacenow.org) to try to do a huge installation of small scale residential and business installations.

He put it into numbers that he’d CLEARLY spent time going over assuming that $100 million spent on installs would equate to about 10 MW of production. He then pointed out that demand in our area for power was almost 700 MW.

NV Energy has a state mandated goal of 25% renewable production by 2025. It would take $1 billion of P.A.C.E installations to meet 15% in local installations. The man I spoke with welcomed ANY effort to speed adoption of small scale local generation. He presented a few slides showing that ENORMOUS challenges of Utility Scale solar and that our grid could only handle about 8% of that, but that the number might double or triple with distributed small scale generation.

In short stop assuming that the Powers that Be hate Green. Many of the beneficial shifts we’ve seen have been the persons in charge of large companies seeing ways they can be part of the solution and implementing change. Utility Companies are often slow to adopt new technologies, but when obviously excellent options show up they DO eventually accept them with open arms. As a rule of thumb, what’s smart makes cents and if something seems obvious yet it’s not being implemented, you probably don’t see the whole situation…

[shortened by moderator]

I’m going to wager that you live in California. Most of the rest of us (in the USA) pay about $0.10/kWh for power. I live in central Texas and run a woodworking business out of my garage, so I use about 100 kWh/day on average. My electric bill is about $300/month.

I looked into Solar. I need a 20 kW system to offset my electricity use (100 kWh = 20 kW x 5 hours of usable sun per day, on average. We actually get weather here once in a while.)

At $4/watt (installed, grid-tied, no batteries) that’s an $80,000 system. There are no significant tax advantages (I can neglect the added value to the house on my property taxes, but that’s it.) Financed at 5% over 20 years (the lifetime of the solar panels, so I’m told) that’s $528/month. Not a good return compared to the $300/month I currently pay and without risk of hailstorm, vandals (there are some bad kids in the neighborhood), monthly cleaning, etc… BUT, if the cost of grid power doubled, Or the cost of an installed solar system could be had for under $2/watt, then this would be a different story. However, even if the panels are free, the cost of installing and wiring them would still be about $2/watt (at least, based on the quotes I got.)

Suppose non-renewable energy sources (including uranium) were taxed with an ever-increasing “limited resource” tax, based on the logistical curves above. Tax breaks would be issued where that energy is used to manufacture renewable resources with an EROEI greater than some minimum amount. But then, look at California’s economy. Did expensive energy create some of those problems? What we really need are to get the physicists and the economists working together, along with an interpreter who can make things simple enough for the politicians and the public to understand.

In other words, we’re all doomed.

Well, I’m in Arizona, not California. Our electricity is in the $0.10 – $0.12 / kWh range. Mine is a 6.24 kW PV array plus a separate solar hot water system. My usage is roughly 10 MWh / year, which the PV array would cover by itself; the SHW roughly offsets about what my back-of-the-envelope figures suggested I’d use with an electric vehicle.

The Federal government offers a 30% personal income tax credit on the installed price. That’s not a deduction, but a credit — if the system costs you $80,000 installed, your tax bill will be reduced by $24,000. (I have no clue what, if any, incentives are available to businesses.)

Between that credit, a $1,000 state tax credit, and a local utility rebate of $1.35 / watt of installed capacity capped at 5 kW, my total system cost was roughly $12,000 for the PV and $3,500 for the SHW. That’s just under $2 / watt.

According to the spreadsheet supplied by the installer (American Solar Electric, an Arizona company I can’t recommend highly enough), break-even on the PV system (assuming 5% utility inflation and other similar conservative figures) is at about the nine-year mark and the SHW at about seven years. Consider that I actually have enough spare capacity to drive an electric vehicle (that I don’t yet own) for free, and that break-even point happens a lot sooner.

Thanks to the Rule of 70, we know that a seven-year payback period is equal to a 10% annual rate of return. Worst case, if I never get an electric vehicle, the PV system is still close to an 8% rate of return, which is hardly anything to sneeze at.

Without the state and utility incentives — the worst case an American taxpayer could possibly face — the payback period would have increased by a couple years, bringing the effective rate to the 6% – 8% range, still most respectable.

Cheers,

b&

Yes i left the grid and developed a windmill,solar cells have my garden which provides for all of my food… chickens too. Undergroudn greenhouse, water collection system, sewage, solar heaters etc. I do have a woodworking shop and I run a diesel generator that runs off sunflower oil which I press myself.. again run by a diesel.

Once i started down this road it became easy to do more as i understood our predicament. I now have no expenses except land tax. See the web site continuo.com -mat

We are just finishing our off grid solar home in Mayhill and the big surprise for me is how well a solar home heats it’s self. We are still living in the 120 year old ranch house and pour cordwood into it to stay warm, when we work on the new house during the day it is warm as toast in the winter with no additional heat. Our biggest energy expense is our water pressure pump and our refrigerator which are both 24 volt D/C. Our well pump is even solar and does a fantastic job.

Building design can go a long way to mitigate energy usage. Energy has been cheap in the US and our infrastructure is no where near as efficient as it needs to be.

Tom, thank you for carrying the banner, I love the work that you and Jim Hamilton are doing at UCSD. If we are aware of what the future might hold, we can position ourselves appropriately.

Drop by next time you are in the Sac’s!

Great post. My only bone of contention is the market-bashing bit at the end. I think that the market would do a great job helping us solve or weather this problem, so long as the markets have good information and realize the scope of the problem. There’s an *enormous* opportunity to profit for any business that helps industries currently addicted to fossil fuels to efficiently wean themselves. The transportation startup that chooses to purchase a fleet of electric vehicles will be able to outcompete the status quo companies when fuel prices skyrocket. The agribusiness model that is most divorced from fossil fuels will be able to flourish when its industrial-scale competitors are being crushed by peak oil.

I’m not saying there’s no role for central planning, but I think right now our biggest problem is a matter of understanding (dare I say belief?). I think the market will adapt if it is given accurate enough information with enough lead time to make the necessary adaptations. Some may not adapt quickly enough and they will suffer, while those who adapt quickly (like Mr. Goren, above) will flourish.

That’s why posts like this are so important. If (market) decision-makers can be made to understand the seriousness of these issues, the rational choice is to make the type of investments Mr. Goren spoke of above.

I hope you’re right. What worries me is that this problem requires full-scale response 20 years ahead of the pain. Market emphasis is on short term. I’m not saying long-term thinking is absent. But it’s diminutive. Uncertainty and price volatility cripple advanced planning. There will certainly be some individuals and companies moving in smart directions ahead of the chaos, but not in the numbers we would need to see to make me wipe my forehead with a “whew!”

I definitely agree with your last point: we have to be aware of the danger if markets have any chance of saving us.

The recent “Carmageddon” episode in Los Angeles (July, 2011) is a great example of how an aggressive campaign can turn the tide: Thanks to a well-coordinated full-scale effort to educate the public about the limits to traffic ahead, people took heed, adjusted their behaviors, and produced the smoothest traffic Saturday in L.A. in recent memory. This is effectively what I am trying to do in a very small way via Do the Math.

In that spirit, perhaps you could do a post that compares the financial return and potential risks for various personal investments, including solar, gold, cash, and stocks? Not at the societal or institutional scale, but the sorts of things that a typical American family might put its money into.

Cheers,

b&

The thing is you have a receding horizons problem. Fossil fuels, especially oil, are fundamental inputs into virtually all other energy sources. As oil depletes, you are likely to see increased price volatility of a (possibly, the) core component of your new market-based solution.

Volatility and high prices are not the friend of innovation or, just as importantly, the scaling from innovation to production. Unless your market-based solution is also a fossil-fuel-free solution, your business will have to be financially viable in a “free market” that works well in the presence of high and volatile energy prices.

This affects materials, production, transportation, maintenance, virtually every aspect of virtually every meaningful energy technology identified to date.

Mr. Market may yet save us, but I don’t think that that bet is anything close to a sure thing.

“Volatility and high prices are not the friend of innovation or, just as importantly, the scaling from innovation to production.”

High prices good. They make it worthwhile to develop alternatives.

Volatility bad. It creates uncertainty. I’m sure that if gas prices in the past ten years had been steadily and predictably rising, instead of wildly fluctuating and repeatedly crashing, we would have adapted a lot better than has been the case.

Mr. Market isn’t predictable. That’s why policy matters. Now, the US does not have an energy policy. That’s why we are stuck with market failures.

Tying some thoughts together: rather than relying on central planning (government) or market “decision makers” (corporations, venture capitalists, etc.) , my hope is that individuals (like Ben and like me) start taking personal actions to hedge against peak oil and the resulting demand drives market adaptation. This works if the concept of post-peak petroleum pitfalls penetrate our consciousness in large numbers—which, again, is what I am trying to accomplish.

We had this discussion before and the problem is not just that the market is too short term. The problem is that the market provides spectacularly wrong incentives by failing to price negative externalities. Unfortunately there’s no way that individual action can correct this massive market failure.

http://www.nybooks.com/articles/archives/2011/oct/27/energy-friend-or-enemy/

http://www.slideshare.net/amenning/energy-sustainability-9683394

Let’s not forget how distorted the market already is, though. One simple (well, it should be simple) thing to help push the market in the right direction is to get rid of all the fossil fuel subsidies. Right now, they’re much larger than the subsidies on renewables (something on the order of 5x as much).

And yes, something that would push the market to look further ahead would be a huge boon to all industries (I have no idea how to even approach that one, though).

One aspect of peak-oil-mitigation which should get some more attention is, instead of focusing on one-to-one replacements of liquid fuels and the existing transportation fleet, to look at what’s feasible for different approaches to infrastructure. For one, (re)electrifying the railroads, and then asking how much freight can be moved by (electrified) train instead of truck. Then ramping up intercity rail, to replace 500 mile and shorter airplane flights, and rebuilding electrified interurban rail, and building out the subways and light rail networks that are presently considered “future expansion” routes. Alan Drake has written a few quasi-quantitative pieces about this, but I think there’s more analysis to do.

The first thing that’s enticing about electrified rail is that the technology is already a solved problem; you don’t have to hope that progress trends for batteries or what not continue for another decade. But more compelling, I think, is that if you believe that there will be a solution to the overall energy picture, even if we don’t have it at hand yet, then whatever solution(s) turn out to be the winners, we’ll be able to generate electricity from them. A bet on the wrong technology now could lead to a bunch of useless equipment in the future, but whatever combination of solar, wind, geothermal, methane hydrates, nuclear, tar sands, biofuels, nuclear fusion, and whatever else that makes up the energy of the future, we’ll be able to make electricity from it.

“What amazes me is that each time we discover a few-billion barrel deposit in the world, the trumpets come out and the headlines gush with the news.”

Absolutely. Witness this NYT article from September 23, 2009:

“It is normal for companies to discover billions of barrels of new oil every year, but this year’s pace is unusually brisk. New oil discoveries have totaled about 10 billion barrels in the first half of the year, according to IHS Cambridge Energy Research Associates. If discoveries continue at that pace through year-end, they are likely to reach the highest level since 2000.”

Only close to the end of the article do we find this reminder:

“Since the early 1980s, discoveries have failed to keep up with the global rate of oil consumption, which last year reached 31 billion barrels of oil.”

[moderator note: please keep comments much shorter than this: long comments discourage readers, so I often discard over-long comments (see discussion policy).]

Why did supply match rising prices until ~84 Mbbl/day production, then level off? There can be a good deal of debate, but don’t forget the effect that OPEC had at that point. OPEC analysts stated simply that there wasn’t actual, true demand for oil, that prices were out of sync with production, and that adding production would not actually lower prices. Now, it can be debated whether or not OPEC actually *HAD* spare production capacity at that point… they could have simply been covering their collective butts and avoiding the panic that a statement like “We are producing at maximum and cannot keep up with prices.” would create. Global demand was at a peak, but so was global supply. However, crude inventories were neither at historic highs or lows. If they had been at historic lows, the high prices would have reflected concerns over how global supply would handle a disruption in production. But, if I recall correctly, this was not the case. Crude oil futures were being used as hedges against increasingly bad bets in other areas of the financial markets. Recall that within 3 months of the peak of high prices, we saw a local minima below $40 a barrel. Had demand really dropped that significantly in that short a period of time? Fewer people were driving to work, sure, but the additional percentage not on the roads wasn’t that significant in the grand scheme.

So, in analyzing a plot that puts global production at capping out at ~84 Mbbl/day in response to increasing prices, it is worth remembering:

1) There is a cartel that controls a significant portion of the world’s oil supply. It is in their best interests to keep oil at a sustainably high price. High enough to encourage investment in finding new supplies, but not so high that economies are crushed by high energy prices. However, they have little interest in “moving the valve” if increased production will not affect prices, such as the scenario as the housing market collapsed.

2) There is current maximum to production capacity. That number changes every day, and would increase in time. Meaning that some supplies may take hours/days to bring on-line, while some supplies may take weeks or months. Then there are the supplies that will take many years to bring on-line simply because they are undeveloped discoveries/reserves. It takes a long, long time to bring a field into full production. The fundamental problem with trying to respond to a short term surge in price (not necessarily demand) with increased production is one of dead time and time delay. Companies / nations need to see prices sustained at a high enough level to justify developing a resource before they will commit resources (dead time), and then it takes time to actually develop a resource (time delay).

However, I am not arguing your fundamental point that there is “peak oil”. There will be a peak in conventional oil (we may be already there), and there will be a peak in other types of hydrocarbon resources. The medium term outlook (next 100 years or so) will see several “steady-states” where we’ve developed new types of resources, and continue to chug along (unless we manage to poison our environment too badly). However, it is the dynamics of how we get to those steady-states that has me worried. See above, where I reference the issue of dead time and time dealy in development of resources. As the post states, the longer we wait, the worse off we will be when the time comes that we need an alternative resource. Unfortunately, companies/nations tend to look out into the short term… the next quarter to the next election cycle. Sinking billions into unproven/risky technologies and projects where profitability depends on rising conventional energy prices is tough to convince shareholders / constituents. Fundamentally, in the long run, it makes sense. However, in the short term it can get you fired.

Great post.

I am a civil engineer and am deeply concerned about peak oil. My question is: what can we do with no money? Regardless of what we hope, the current political climate, which will not change much in the coming two decades, will not allow either massive debt-financing or massive tax increases. I appreciate your opinion that we need one, but there will be no Apollo program.

I would aim to transition the economy from a material-consumerist one to an non-material-consumerist one. So health care, security, research/education, and entertainment are the way towards a slightly more sustainable growth model. Those are all jobs factories that could be expanded four-fold.

“No money”

Domestically alone, there is enough “money” to finance 50% of the world’s military expenditures, 1-3 trillion to sink into aggressive war in the Middle East, and trillions to conjure to subsidize insolvent financial institutions and socialize bondholder and shareholder losses at taxpayer expense. There are several Apollo programs in progress at any given time, but the rockets they build are not aimed at the Moon.

I think Tom is absolutely right – the threshold is the admission that we might well have a problem where the multiplier of risk and impact approaches total loss. We have public awareness of climate change, or even possible extinction-level asteroid impact events, but nothing but organized silence regarding peak oil. Once we admit there is a problem, a rational, open society should well be able to repeat what, many decades ago, was done under FDR. It is not the money, it is who gets to control the wealth, and what is done with it. Income inequality is just one leading indicator of a multigenerational misallocation of resources that might very well get a lot of people killed – even more effectively than the privatization of public revenue by excessive weapons manufacturing.

I wonder how applicable Cuba’s Special Period to the wider world would be? Some of the peak oil commentators suggested its a potential example of a sudden transition off of oil.

http://en.wikipedia.org/wiki/Special_Period

This is one of the reasons I think it’s so critical that we invest in cycling infrastructure, and encourage people to live in denser areas, closer to their job and leisure activities. A future in which personal travel is predominantly conducted via motorized living rooms just isn’t going to be realistic twenty to fifty years down the road.

It’s a small component of the overall solution, but one that has significant secondary effects on the rest of the system. Material goods wouldn’t require as much shipping distance to reach the “last mile” of suburbs and exurbs (often the most costly component). And the health of the population would improve dramatically, reducing the resources expended on healthcare. All of these have further secondary effects, and it’s my hope and belief that a small change in transportation policy emphasizing sustainable transportation like bicycles and mass transit can have wide-reaching effects on the consumption of resources in our society.

Fascinating analysis and discussion. Now we need more articles like this geared toward the “ordinary” reader. ASPO needs to work harder so Peak Oil becomes “mainstreamed,” whatever that may entail. At least more persons will have access to this information. In any event, I struck by your observations concerning the inevitability of economic and social chaos. Why are we still standing here talking?

“…we have no historical analog to the peak of fossil fuels, without a clear (and superior) replacement on the horizon.”

Sure we do- Jared Diamond wrote a whole book about them in Collapse: How Societies Choose to Fail or Succeed.

History is a wrecking yard of civilizations that grew up on natural resources, and when the demand for those resources could no longer be met, they collapsed. The difference now is that modern humans have created one giant interconnected civilization, and the sheer number of people that fossil fuels have spawned… the magnitude of the situation is so overwhelming and bleak that most people understandably just choose to ignore it.

I have lived “off-grid” (electrically) using solar and pico hydro power and teach solar technology, and have run many of the numbers Tom details in this fine new blog in my solar classes over the past few years. The problem is always scale. While I can and do harvest and produce the 30kWh a day of electricity my little lifestyle consumes, the average 1GW western US coal powered generation plant requires some 20 railcars of coal in the boiler each day, some 14 of which do nothing but provide waste heat (that pesky 2nd Law of Thermodynamics again). None of that coal can be mined or transported without diesel, which at 140,000BTU/gallon, an energy density unparalleled in human history, does most of the world’s heavy lifting. Given that human population growth has exploded exponentially along with oil production, its fairly obvious that the exponential scale of humanity itself won’t continue as oil production plateaus and declines. When this reality becomes obvious to “ordinary” people – sadly but aptly called “consumers” – the scale of the misery expressed as the paradigm shifts will preclude rational response.

I think you might overemphasize the “subprime” aspect. Hussman is somebody who Does The Math:

http://www.hussman.net/wmc/wmc100315.htm

http://www.australian-real-estate.net.au/investing/wp-content/uploads/2010/07/USA-mortgage-loan-resets-chart-2006-20121.jpg

That bubble is still deflating.

Great post, Tom. I have spent a decade studying this same data and writing about it, and I agree completely with your conclusions. Thanks for doing the math! It’s a shame that more people don’t (or can’t).

Many of the studies so far, including the Hirsch report, indicate that the most immediate (short term) problems from peak oil will be in liquid fuels. Since liquid fuels are used primarily in transportation, this becomes a transportation problem. So in setting priorities, we need to have a hard look at our transportation system, given the possibility of a relentless 3-4% annual decline rate in fuel supply once we fall off the plateau. Could it adapt? How to hedge against this possibility? What timelines are required? Perhaps a sustained liquid fuel crisis is the wake-up call that is required to shake up the public and get some real long term policy discussions going in the open.

This post is an articulate and well argued version of what pretty much anyone with a science background, who has researched this matter, already knows.

The message won’t get through to the people who make the big decisions though, and the reason is the discipline of economics. Economics is a discipline which speaks in scientific terms, is mathematically self consistent, and almost entirely wrong on every occasion. Yet it has, through flattering the powerful, attained a position where it defines all public debate in its terminology. Politicians can and do use the language of economics to make their uninformed whims (and the whims of their backers) sound like the only scientifically objective response to any particular situation.

You cannot win a debate conducted in the terminology of economics, because economic terminology can be used to back almost any point of view, and those who already have money and/or power will be able to win by shouting you down.

Even worse, the ruling elite seem to have started believing this sincerely. Here in the UK, the government response to the current crisis has, between two different parties, been to shuffle money around the financial system and create new currency ex nihilo. They are treating cash as if it were a real, physical, input.

Another great post for a great blog–thanks.

How deeply have you looked into these estimates of other fossil fuel resources–especially coal? Many authors glibly assert that there’s enough coal to last 500 years or something like that, but in my casual reading I’ve never come across a discussion that takes these estimates to the next level of detail, which would include the increasing cost of mining coal that’s ever harder to get to. Nor do many authors acknowledge that as other fossil fuels run out, demand for coal will presumably increase. The Brandt & Farrell graph seems to imply a constant cost throughout the time over which this resource is depleted, and that can’t be correct.

I know you’re mostly concerned with the short term, but I’d welcome a future post on the longer-term outlook for fossil fuels.

Unfortunately, people are not receptive to the Peak Oil message. Just look at T. Boone Pickens who has been talking about Peak Oil since 2006. Have people heeded his warning? Nope. Or how about the late Mathew Simmons? Did people listen to him? The world has enjoyed the good life oil has provided for so long they don’t know anything else — and don’t want to know anything else. I don’t want to be pessimistic, but having tried to alert people to Peak Oil since 2008, I have given up. As to the technicalities of Peak Oil, you highlight a crucial point about finding substitutes for conventional oil which is the rate of production. World consumption of oil is so large it’s simply impossible for Bio-fuels or Tar Sands to be a viable substitute. One final point: Russia claims oil reserves of about 60 billion barrels and produces 10 million bbls per day. Saudi Arabia claims oil reserves of 260 billion barrels and produces 9 million bbls per day. Who is lying?

Exactly.

This is what I find really, really depressing.

Not the fact that the end of fossile fuels is coming, but that we could adapt somewhat, but won’t even try before it’s too late.

When you think about it 5 seconds, it’s evident that oil quantities are limited. Yet, when I try to speak to people about the problems raised by this blog, they just ignore it, because, well, it requires them to stop and think for 5 minutes (people are lazy!!!) and, what’s more, it “depresses” them.

There’s also the “way of life” train of thoughts: about 90% of my collegues live in suburbs (and we’re in france, when living in town ain’t difficult). They commute each day, and all love having their house, land and swimming pool, and absolutely don’t want that to go away. So when oil price rises, they protest against it and the government instead of moving closer to the town.

And then, there’s greed. Be it oil compagnies or the OPEC, they all know the bounty is gonna end, but they all have an interest in keeping the status quo running for the longest time possible.

As for the market, it’s all focused on short-term gain, the future may be damned, I have even less hope from it thant from anything else.

Thanks for trying, tom, thanks for the good posts and clear ideas. I just fear your efforts may be doomed.

This is a very good post and your thought process mimics my own to a certain extent.

I’ve tried to look at the evidence of continued oil production with critical eyes, but also against the Peak Oil camp. I don’t want to become emotionally invested in one viewpoint or another.

The best skeptic argument I can come up with is that we’re not awaiting a world ‘awash’ of (cheap) energy but rather that Iraq and Libya, together with a million or two mb/d from the Saudis will delay the peak slightly until unconventional really takes off ground.

I read a lot of extremely negative posts on places like TheOilDrum.com (by your personal favourite Gail, by the way) which totally dismissed the shale production in North Dakota. She basically said we’re looking at 200,000 b/d production at best for the next five years and not much after that. We’re almost at 500,000 just a year or so after her prediction. Bakken could easily get to 2-3 million in 4-5 years, and then you have the oil shale from the east coasts and the rest.

In truth, there are good counter-arguments to this too, not least that the natural decline of the exisiting oil fields is like 3.7 mb/d each year(but then again, that has been the case for many years now and we didn’t drop production since 2004 despite the stagnation), as well as healthy skepticism of just how fast(and crucially; how cheap) you can crank up the shale production in the U.S.

My personal thoughts is that once we enter the later stage of this decade we’ll know for sure. By then any potentional offset by Iraq/Libya will be gone or at the very least in full use, and the promises of shale oil will be for all to see.

But even if this optimistic scenario occurs, I think that we’re in for extremely tough times, young people today en masse are basically going to be a lost generation. And in these tumultous times ahead, revolutions and revolts can easily happen. What would happen if Iraq descends into chaos again, or if Iran and Israel duke it out? And so forth. Even if the below-ground conditions are fragile but hopeful, a strained situation inevitably raises the geopolitical risk many times over. This is a factor often poorly understood. The Arab Spring happened in a context of rising food prices, staggering unemployment. And in the Western world we have mountains of debt which show no signs of abating.

We’re not just facing an energy crisis. We’re facing the crisis of population and resources at the same time, which shows itself through Peak Oil, climate change, unfettered capitalism and globalization and so forth.

I don’t view Peak Oil as the defining feature of the next decade or so, even if it has a primary role, it is nontheless(sadly) just another player in the schemes of the future.

Excellent summary, Tom.

Regarding the length of the original post, never mind the width, feel the quality. 😉

One big factor not considered is the rather scary Export Land Model – plenty of numbers to play with on that one when you come to revisit the Peak Oil issue.

cheers

Mustard

Great article. My only objection is to the use of rate-vs-cumulative-production curves for predicting the future. I believe these graphs are useful, but only in hindsight.

These curves always fluctuate wildly at the beginning, before settling down to a linear relationship. This isn’t a fluke: they all do this. And if you label the data points, you discover that the point at which they settle down is the point of peak production: you can only reliably estimate the ultimately recoverable resource at or post-peak.

Case in point: suppose you’d tried to estimate US oil URR in 1950. You’d see a nice linear relationship, which intersects the X axis at an URR that’s wrong by a factor of 2-3. And without knowing the future, you’d have no way to know you were wrong. Same for Pennsylvania anthracite.

We may already be past peak oil, but these graphs won’t tell us until it’s already obvious.

For the PA anthracite, UK coal, and U.S. oil, the trend-line stabilized to the final form well before peak. Note in the world case that I ignored the initial mayhem, and only attempted a fit once the trend stabilized (before the peak). The same method on the others would turn out to be pretty reliable. I’m not going to defend this technique any more than it deserves, but I think you sell it short: the examples shown settle down well before peak.

Great post. Probably naïve of me, but I am more horrified by any prospect of realization of that Brandt and Farrell chart, than by the prospect of collapse. Yikes.

Yes, hydrocarbons are there. It’s a money and transition problem within the span of the next 40 years or so. The problem is oil price feedback. Oil is getting more scarce, and will eventually get more expensive. As high oil prices work their way down the value chain, the price of everything increases, including the price of locating, extracting, refining and distributing petroleum products. How many price spikes can we endure before we find that oil has lost most of its utility as an economically viable energy source?

Capitalism or “the markets” act like a bacteria colony, reacting to immediate conditions. They’re not so good at thinking ahead. You need a brain (i.e. government) that can see past next quarter’s profits or the next election if you want to avoid difficulty. That’s where we fail.

[shortened by moderator]

In terms of viability of alternative personal transport, I don’t think electric vehicles (run by Lithium Ion batteries) look possible. This link has already ‘Done the Math’ for me:

http://tyler.blogware.com/lithium_shortage.pdf

Trying to summarise, for current Lithium batteries, […] the Lithium Carbonate required is […] 225,000 tonnes. This is about 3 times current global Lithium Carbonate Production.

Thats not to say we can’t scale up Lithium Carbonate production,but then again, we may not have that long!! Of course like all resources (even ones with huge proven reserves) it is the rate of extraction that is all important.

However I think electric bikes might offer some small hope of at least breaking our fall (for personal transportation only mind you)

Total bikes [with 20 mile range] that could be made using current production (2005) = […]

= 72.9 million. Assuming that one bike replaces only half a car, that would mean about 35million cars replaced… (about 3% of total car stock a year)

Combined with electric rail, buses (public transport in general) and more car sharing, the transition for personal transport with strong emphasis on electric bikes rather than cars looks doable.

In general I think that Tahil reference commits a fallacy in the use of the term “consumption” in regards to lithium. Lithium, unlike energy, is not consumed. It is safe to say that there will be just as much lithium on the plant a thousand years from today regardless of what uses may be found for it. If EV transportation does reach mass adoption, and I expect it will, then there can be little doubt that lithium battery recycling will also become widespread.

Otherwise Tahil has been shown by the geologist Evans to be using severely flawed assumptions and data.

http://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=1&ved=0CB0QFjAA&url=http%3A%2F%2Faction.pluginamerica.org%2Fo%2F2711%2Fimages%2FWorld-Lithium-Resource-Impact-on-Electric-Vehicles-v1.pdf&ei=PY-4ToL2BMrs2QX2tqW1Bw&usg=AFQjCNHTh2CgnFvw0UxgMKbLtFRXnzMwGw&sig2=MwAz7KhK_wvpZJ462T__CA

Tom, I just wanted to thank you for your article- but for a reason you might not expect. I have read many, many articles on peak oil but yours uses clear analogies and images so effectively that it seems like the definitive piece on the subject. I am a teacher and really appreciate clear, easy to understand prose combined with effective examples. What is strange is that your web site is called “do the math” so you would expect a quant heavy mess- but you have a real talent for communication and turning numbers into reality. By all means do not stop posting- this is the best I’ve read on the subject. You must be a teacher also!

If you follow the blogosphere Keynesians, you’ll frequently find them talking as though they were surprised that policymakers, too, are subject to that dread human thing, *psychology*. This or that technocratic solution would get us out of this mess, they insist, if only policymakers would see sense, resist both instinct and incentive, and act. But the grain of the vitiation of their prescription sits even in their analysis of the problem. If a recession is a psychological phenomenon — a crisis of demand in which everybody is seized with a collective desire to save and to invest in safe assets — there is no reason except one founded in a moral idealism these thinkers otherwise disdain to exempt so undistinguished a category of people as *politicians* from this collective fit of conservatism. If money is a social construction, perhaps debt is hope, and a recession is a phase of hopelessness it must take more than the ingenuities of technicians to retrieve us from. What if, indeed, the salient lesson of 1937 is not economic – austerity is contractionary, so counterproductive – but political: that austerity was something *not even FDR* could avoid or avert; it was overcome only with the advent of world war, and with a psychological correction of a corresponding scale?

Yes, psychology, but the situations are different. The paradox of thrift is a coordination problem, and one of many examples of the fallacy of composition, or prisoner’s dilemma problems, or externalities; individually rational behavior leads to generally irrational outcome. If we all accepted a nominal wage cut together, things might work, but no one wants to go first, especially if they have debts that won’t be changing in amount.

OTOH, the whole point (ideally) of politicians is to coordinate, to be able to look at the whole and make national decisions that individuals can’t because they are individuals. They may face obstacles, like ignorance of the economic theory, inability to believe in a “free lunch” and non-belt tightening measures, or captivity to wealthy interests who benefit from deflation and low taxes, but they do not face the same obstacle as individual people and businesses in a recession.

One additional variable is introduced because hydrocarbons aren’t really fully interchangeable. A world run on a liquid energy source that can be easily stored and transported is an entirely different from going all-electric (which requires an electrical grid that hasn’t been built yet), to hydrocarbon gas (would require massive infrastructure changes), or to more problematic hrdrocarbons. Biofuels could resolve this somewhat, but corn ethanol certainly isn’t it an answer and biodiesel is far, far worse unless the algae hacks work (and maybe not even then).

They’re not fully interchangeable but they are interchangeable. Gas to liquids, coal to liquids. I don’t know what the energy ‘tax’ of converting X amount of gas or coal to oil is. If it’s 2/3, like converting heat to work typically, ouch! If it’s 10%, that’s not so much and possibly comparable to the work needed to get scarce fossil oil out of the ground anyway.

And AIUI such conversion is proven, commercial, technology; it’s not widespread because making oil is more expensive than sucking it out of the ground, or has been. Unless you’re South Africa, or have lots of natural gas you can’t ship easily; thus SASOL and some gas to liquids plants in the Gulf. Like electric trains, this is a high-investment but no-research technology.

Damien – Shell has a Gas-to-Liquids plant in Qatar built at a cost of around $20 billion which produces about 140,000 bbls of liquid fuel per day. Since the world consumes 74 million bbls of oil every day, the investment to meet world demand would be prohibitive (“do the math”).

The closest thing I’ve seen to a plan is Mark Jaccard’s book “Sustainable Fossil Fuels.” Jaccard’s an academic and policy advisor here in Vancouver whose expertise is in energy (he’s a former IPCC member, was involved in setting up the carbon tax in British Columbia, has put forward concrete proposals for Canadian climate policy, etc.). Based on the Brandt & Farrell graph (and arguments about medium-term price elasticity–high oil prices tend to reduce demand and increase supply over the medium term), he thinks we’re likely to be able to continue extracting and burning hydrocarbons for 100 years or more. Which makes for a big climate change problem.

Jaccard analyzes the four alternatives: fossil fuels, nuclear, renewables, and conservation. His conclusion is that nuclear, renewables, and conservation are all important, but that fossil fuels are still going to be a significant part of the energy supply over the next 100 years.

His view of the future looks something like this:

– Transition vehicle fleets from gasoline to electricity over 10 years or so (average expected lifetime of a new vehicle). Battery technology has improved enough that hydrogen (requiring a whole new infrastructure) will never happen.

– Continue to use coal-burning or gas-burning power plants, but with 100% carbon capture and storage (CCS).

– An internationally-harmonized carbon tax (something like William Nordhaus’s “After Kyoto” proposal), so that people don’t treat the atmosphere as a free waste dump. Without a carbon tax, the electricity generated by CCS-equipped power plants will be more expensive than non-CCS electricity (IEA estimate of cost difference: 1-3 cents per kWh).

I also wanted to say, thanks for publishing this blog! I’m reminded of Paul Krugman’s discussion in “A Country Is Not a Company” of the difference between thinking about an open system (a company) vs. a closed system (an economy). If we can’t colonize space–and your “Why Not Space?” and “Stranded Resources” posts are pretty convincing–then we’re going to have to learn to live within a closed system.

It seems that nearly all TV and movie depictions of the future (not just Star Trek and Star Wars, but even more realistic movies like Blade Runner and Aliens) assume that we’ll be able to colonize space at some point. The idea that this is impossible, or at least highly improbable, is hard for people to swallow.

“we have no historical analog to the peak of fossil fuels”

Even if we consider peak oil plus anthropogenic climate change, I’m not sure you’re correct. History never repeats itself, but it often rhymes.

Carol Deppe, among others, has floated the idea that the start of the Little Ice Age, with its declining grain yields, is a useful analog to our current predicament. Of course, instead of finishing with once-again abundant wheat, and potatoes and flax on top of that, the end of the story we’re beginning will probably be one of ongoing scarcity of the sorts of resources that had been abundant.

Great post, and great blog.

I began to read about peak oil nearly ten years ago, but still the only reasonable way I see to solve the issue is decreasing our consumes and live in a different more sustainable way.

Anyway, I am always surprised about how small the impact of the peak oil concept and its consequences is on people planning (large scale) future scientific research. It seems to me that everything will become local, so less travels, less conferences, but also in general a decreasing number of researchers. Are we not all doing our nice jobs just because there is a huge surplus of energy (equivalent to the power of several tens of slaves…).

So my question is: how do you think research will change in a world with a lack of oil?

Great question. I wish I knew. Part of the reason we fund research as a society is to keep sharp talent at hand to solve our really big problems. Peak oil presents some really big problems, so one of our responses will be to throw money at research (a little late). But the lack of immediate payback may cause some backlash. Meanwhile, basic research into unrelated (or seemingly unrelated) fields may well suffer if economic hardships relating to energy scarcity drag us down, since such activities are seen as luxuries—even if crucial for long term success.

fabio – that’s an important question, and it’s one I’ve been trying to explore within my discipline (computer science, specifically networking). I recently worked on a paper (really more of a position paper) to consider what networking research might or should look like in the post-peak world. So far I’ve been surprised at the receptive response I’ve gotten from fellow researchers, but also at their general unawareness of this set of challenges.

Tom, this is so spot on. Peak oil is by far the most predictable macro crisis facing us (though water and food shortages are up there as well). We have made our money focusing on major macro events (Internet, Asian Financial Crisis, US Credit Crisis), but over the last 5 years have been focused on clean energy. The scary part is so few people really “get it” and while we have some opportunity to shift away from oil (natural gas and electric vehicles today, with enough focus new fuels in the medium-term), we aren’t focused on this given the jobs and continuing credit disaster.

This is an overview I have presented to the Asian Development Bank and several governments in Asia:

http://www.slideshare.net/ronmahabir/peak-oil-the-clean-transportation-opportunity

Thanks very much for releasing your views publicly! We need more scientists actively behind this.

Krugman has a column on solar energy. Good roundup at http://thinkprogress.org/romm/2011/11/07/362705/krugman-solar-power/.

Krugman makes some important points regarding the de facto subsidization of fossil fuels by current energy policy. Let me reiterate that the escalating cost of fossil fuels is actually not what we should be concerned about right now. What we should really be concerned about is that the cost of fossil fuels is currently way way too low. Yes it will go up to a point where it hurts but right now we are paying hidden and not-so-hidden subsidies for inefficiency and waste.

A discussion of peak production is incomplete with out its complement, demand, and the term is barely referenced here. In the US demand has been falling since 2005. US annual consumption (19.18 mbbl/day) is now at 1999 levels. US per capita consumption is at levels not seen since the 1960s.

http://www.eia.gov/steo/cf_tables/steochart.cfm?periodType=Annual&startYear=1992&startMonth=1&startQuarter=1&endYear=2012&endMonth=12&endQuarter=4&formula=PATCPUSX

In the US and globally, demand has been plateauing. To say that demand is falling is a bit of an overstatement. There has been a slight drop due to the recession. On a per capita basis yes there is a slow decline in most developed countries.

CO2 emissions from fossil fuels unfortunately have only dropped slightly during the recession and have jumped to record levels last year.

*Biggest jump ever seen in global warming gases*

http://www.sacbee.com/2011/11/03/4028408/biggest-jump-ever-seen-in-global.html