Having looked at the major alternatives to fossil fuel energy production (summarized here), we come away with the general sentiment that the easy days of cheap energy are not evidently carried forward into a future without fossil fuels. That’s right, fossil fuels will be dead and gone. Is it time to pile them on the cart to be hauled away?

In the slapdash scoring scheme I employed in the alternative energy matrix, the best performers racked up 5 points, whereas by the same criteria, our traditional fossil fuels typically achieved the near-perfect score of 8/10. The only consistent failing is in the abundance measure, which is ultimately what brings us all together here at Do the Math. Fossil fuels are presently used in abundance—85% of current energy use—but this is a short-term prospect, ending within the century. The first effects of decline may be close at hand. Do I hear talk of nursing homes?

The gulf between fossil fuels and their alternatives tends to be rather large in terms of utility, energy density, practicality, ease of use, versatility, energy return on energy invested, etc. In other words, we do not merrily step off the fossil fuel ride onto the next one by “just” allowing the transition to happen. The alternatives come at a cost, and we will miss the golden days of fossil fuels. But wait…what’s that murmur? Not dead yet?

Still Got It?

Before we leave fossil fuels for dead, we should understand that peak oil happens around the time that the resource is half-depleted. So we’ll have many decades of conventional oil, albeit at dwindling rates. Likewise for gas and coal, whose peaks may be decades away still (but likely this century all the same). My main concern is how we cope with the decline stage of fossil fuels, which is not as final as being dead, but effectively forces us into a new era of energy transition. Because conventional oil will begin its decline first, a chief concern is how we might replace its function for transportation. Rather than write off fossil fuels completely, some see promise in what alternative fossil fuels might offer.

Indeed, a number of non-conventional fossil fuels may represent our most convenient next step in energy. The low-hanging fossil fuel fruit has been plucked, so that the conventional sources get progressively harder and more expensive to acquire. Meanwhile, the ground is full of sub-prime fossil energy that becomes exploitable as the conventional resources wane (and become more expensive). If inferior replacements for conventional oil turn out to be exploitable at scale, our concern may shift more to the climate change side of the story: many fear that we may run out of atmosphere before we run out of hydrocarbons—and they could be right.

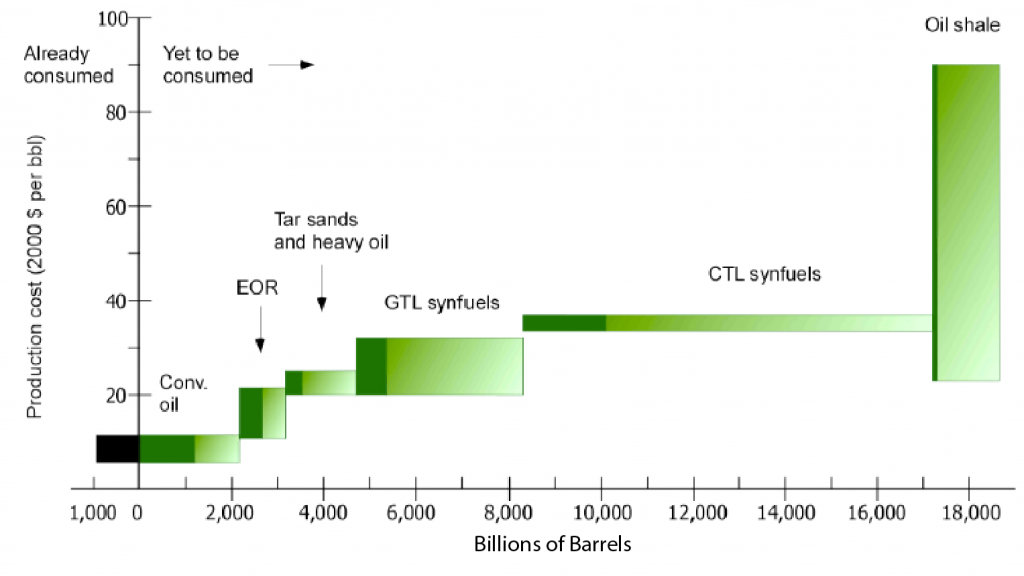

In a strictly quantitative sense, the notion that we have an abundance of hydrocarbons yet may be accurate enough. I used the following plot in the post on peak oil, adapted from Brandt & Farrell. Dark shades indicate reliable resources, while light shades represent increasingly speculative holdings.

We are about halfway through the conventional oil endowment—thereby near the production peak assuming the usual symmetric performance history. But perhaps we can recover a much greater fraction of the oil in the ground through advanced oil recovery technologies. Then we have tar sands and heavy oil from Canada and Venezuela. Or we can liquefy natural gas to cover the oil shortage. And as the Nazis and Apartheid South Africans demonstrated, liquid fuel can be produced from coal. Finally, we have a potential option in oil shale. Resource estimates vary, but even taking the dark green segments in the picture above (reliable lower-bounds), we at least triple the remaining “liquid” hydrocarbon resource available.

We are about halfway through the conventional oil endowment—thereby near the production peak assuming the usual symmetric performance history. But perhaps we can recover a much greater fraction of the oil in the ground through advanced oil recovery technologies. Then we have tar sands and heavy oil from Canada and Venezuela. Or we can liquefy natural gas to cover the oil shortage. And as the Nazis and Apartheid South Africans demonstrated, liquid fuel can be produced from coal. Finally, we have a potential option in oil shale. Resource estimates vary, but even taking the dark green segments in the picture above (reliable lower-bounds), we at least triple the remaining “liquid” hydrocarbon resource available.

By the way, I recommend totally ignoring the vertical axis on the plot. Cost of extraction tends to rise as energy prices rise, and these estimates are rooted in a cheap energy economy. At the very least, the lines should slope upward, as the tail end of a resource is always more costly to extract than the early stuff. In any case, I consider the cost estimates to be unreliable.

Let’s just put a timescale on this resource. 4.5 trillion barrels of remaining “liquid” hydrocarbons, at today’s rate of petroleum use, would last about 150 years. But it does not work this way. In most aggregate resource situations, the peak rate of production is reached when half the resource is gone. In this case, our total 5.5 trillion barrel “liquid” resource—past and present, devoting remaining coal and gas to liquid form—would be halfway depleted in 60 years, assuming the alternative fossil fuels can step up to the rates we enjoy today. And this does not allow for competing uses for gas and coal, acting to reduce substantially the time-to-peak if fully exploited, so these numbers are too optimistic. Even so, by another measure, if we resumed our growth track of energy use, for instance at 2% per year (more modest than historically typical 3% per year), we would burn through 4.5 trillion barrels of liquid fuel in 70 years. We would reach the halfway point (peak) in 50 years, before tapering down. Any way you cut it, chasing after sub-prime hydrocarbons is another short ride, ending this century, that has the ill side effect of putting us deeper in the climate hole.

The Hirsch Report

In 2005, the U.S. Department of Energy commissioned a study of peak oil and its ramifications. Called the Hirsch Report (summary) after its lead author, the focus centered not on when the peak would occur, but rather on what we could do to mitigate the damaging effects. The report rightly identified the peak oil predicament as a liquid fuels problem, since electricity and heat are more easily substituted by alternative means—though not trivially so.

For liquid fuel replacement, biofuels, electric cars, and hydrogen-based transport were considered not to be technologically ready and/or of insufficient scale. The five options deemed to be ready for large-scale implementation were:

- Increased vehicle efficiency

- Enhanced oil recovery

- Heavy oil & oil sands

- Coal liquefaction

- Gas-to-liquids

Note that not one of these options represents a departure from fossil fuel transport. At some level, this speaks to a desperation in our predicament: we simply are not ready to be weened from the fossils, even as it becomes ever more imperative that we do so.

So what? If the resources are abundant enough, as the figure above suggests, then why not adopt this list of mitigation strategies and just get started?

I’ll make a few global comments before discussing each option in turn.

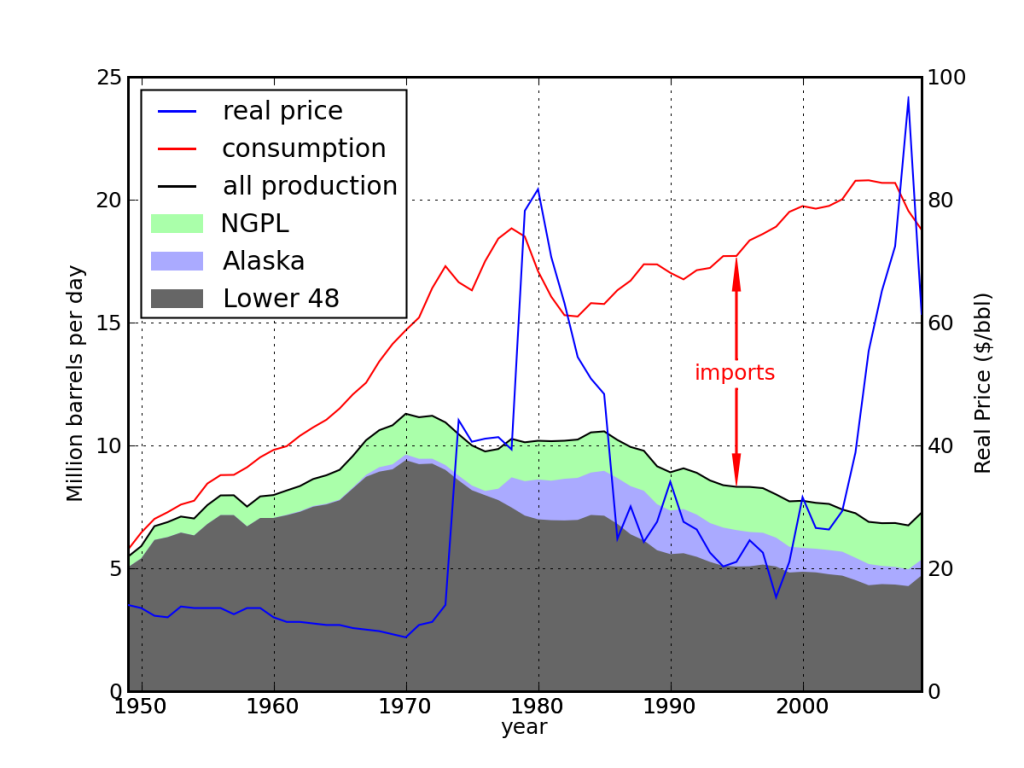

The most significant point is that the declining fossil fuel supply will be experienced not according to the total amount in the ground, but rather according to how quickly that resource is extracted and made available. We face a rates shortage more so than a resource shortage. To illustrate, in 1973, the U.S. was experiencing a declining rate of domestic oil production and got slapped with a Middle-Eastern oil shock that more than tripled the price of oil practically overnight. At the time, approximately 100 billion barrels of oil sat below American soil, most of it already known to exist, and with thousands of wells already accessing many of the deposits. 100 billion barrels would have been enough to satisfy all of domestic demand for over 15 years. Yet imports increased over the next several years while domestic production continued to decline.

Was this some sort of masochism, or the anagrammatically similar machismo? No. All the incentives were there for increasing domestic production, but nature did not care. Real oil wells—as opposed to the hypothetical ones conjured by economists—struggle to move viscous oil through porous rock, and are not amenable to extraction at arbitrary rates set by human demand. There is no spigot: no straw in some underground lake of oil.

Was this some sort of masochism, or the anagrammatically similar machismo? No. All the incentives were there for increasing domestic production, but nature did not care. Real oil wells—as opposed to the hypothetical ones conjured by economists—struggle to move viscous oil through porous rock, and are not amenable to extraction at arbitrary rates set by human demand. There is no spigot: no straw in some underground lake of oil.

Similarly, the raw amount of hydrocarbons in the ground is only part of the story. Can they be extracted and processed at a rate that makes up for conventional oil decline? That’s the key question.

The second global point, as stressed in the Hirsch Report, is that the scale of oil consumption is so breathtakingly large that even a modest decline rate of a few percent per year represents a staggering energy shortfall. Globally, a 3% annual decline in a resource that constitutes a power consumption of 5.5 TW means a yearly decline of 165 GW, or about 40 GW in the U.S. It is a tall order to scale the mitigation strategies up to a point that they could backfill this annual shortfall. For this reason, the report advocated starting a crash program 20 years before the onset of decline in order to assure sufficient scale in time to match the decline when it starts. The report concluded that a lead time of only 10 years risks major disruptions to economies. Beginning the crash program at the onset of decline was considered to be a catastrophic option. And a show of hands: who here thinks we would start an all-out mitigation program at the scale of World War II mobilization before resource decline sets in? If I weren’t typing, I’d be sitting on my hands, even while hoping that I am being too cynical.

A third point is that many of the scales I discuss below are based on a 3% annual decline of conventional oil. For a net oil importer like the U.S., the available oil may go down even faster if any countries reduce their export rate. At least one major oil-exporting country will make the calculation that at double the price, they can afford to sell half as much oil and still keep their economy humming (observing that they are not hurting at present). Oil prices rise higher as a result, tempting others to preserve their black gold for their own uses, only exacerbating the problem. How long will this go before military seizure takes place? In any case, oil importers may face an even steeper decline rate at the hands of geopolitical factors. Such things are not unknown to humankind.

Collecting some thoughts, the mere existence of alternative hydrocarbons in the ground does not translate to a storehouse of resources ready to satisfy our demand at the time and scale we need without decades of steady preparation. Think of a farmer in the flush of late summer waving off concerns of the coming winter because there’s lots of corn on the field, but not bothering to spend the fall preparing for the winter by actually harvesting the grain. An imperfect analogy, but the point is that the scale of the problem requires substantial preparation well ahead of our time of desperate need.

Now let’s look at the Hirsch Report options, recognizing that at best, all but the first are stopgap “solutions” based on a finite resource.

Improved Efficiency

Not technically a finite fossil fuel resource, improving the efficiency of our current automotive fleet does not represent a departure from fossil fuels, but aims to slow down their rate of use. I am a big fan of efficiency gains, and think there are always places to cut. On the other hand, efficiency gains tend to be slow, and do not have unlimited potential, as detailed in the post on limits to economic growth.

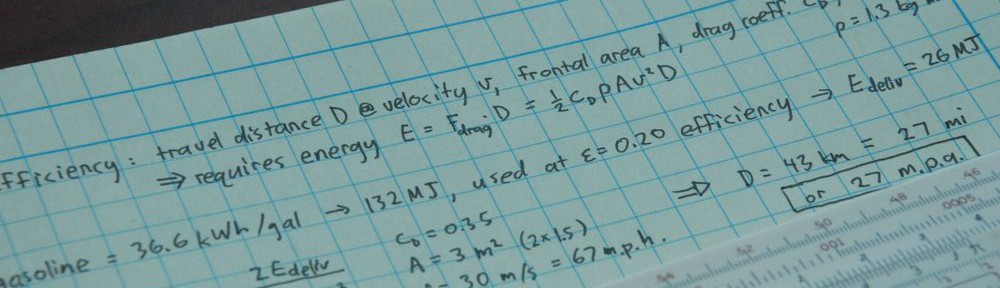

Consider that improved efficiency has been an ever-present goal of our car industry. Few people want their vehicle to be explicitly inefficient: an SUV that got 50 MPG would sell like hotcakes. Indeed, we have seen a steady improvement in the fuel economy of a typical family car, amounting to a factor-of-two improvement over the last 3–4 decades. This translates to an annual rate of improvement of 1% per year. As explained in an earlier post, fuel efficiency boils down to aerodynamics and speed. Embracing smaller, slower, more streamlined cars is the only obvious path forward for improved economy. The Prius is primarily as successful as it is because of its small, wedge-shaped form.

Largely, efficient transport is a well-squeezed lemon. Sure, we’ll get more drops out and should make every effort to do so: 1% per year can make a respectable dent in a 3% decline. Accepting behavioral changes could bring a fresh lemon to the scene. Another way to say this is that we will only see substantial improvements in vehicle efficiency if we change our expectations about what a car is supposed to do (or migrate away from personal cars as a primary means of transportation).

Enhanced Oil Recovery

A number of techniques exist to improve the fraction of oil in a well that can be brought to the surface. Of course oil developers use every practical tool at hand to stimulate oil flow: pressurized water injection, horizontal drilling, hydraulic fracturing, and injection of gas like CO2 to dissolve into the oil and allow it to flow more easily. This last technique generally goes under the heading of Enhanced Oil Recovery (EOR), and can improve the extraction of oil by about 10% of the original in-ground amount. It runs a bit on the expensive side, but future energy will be expensive anyway. So this technique will help offset the decline, if employed at large scale, and has the advantage of delivering light crude oil that our infrastructure is geared to process.

Heavy Oil and Tar Sands

Some oil, like the stuff in Venezuela, is substantially more viscous than conventional oil, approximating tar. Additionally, tar sands in Canada offer similar raw material for making synthetic crude oil. These two resources combined may supply something like half-a-trillion barrels of feedstock. California has a bit as well. Presently, Canadian production is a little over 1 million barrels per day (Mbpd), while Venezuelan production is a little less than this. Optimistic projections expect 3–4 Mbpd by 2020 in Canada. For scale, ten years of conventional oil decline at 3% per year will leave a shortfall over 20 Mbpd. Venezuela is not expected to move so quickly. Put together, these might be able to offset a quarter of the conventional decline—having a head start over other options.

Heavy oil and tar sands require more effort to extract and process than conventional oil, lowering the energy returned on energy invested (EROEI) to something in the neighborhood of 5:1 (reference). At least it’s net-positive, but nowhere near the 100:1 originally enjoyed by conventional oil, or even the 20:1 levels we find in conventional fields of today’s caliber.

Heavy oil and tar sands will no doubt relieve some pressure on declining conventional oil, but they are capable of only partial relief. In other words, just because we believe the resource to be half-a-trillion barrels, rate-limited extraction will limit its ability to mitigate conventional oil decline. Did anyone notice that the U.S. does not own either of the large heavy deposits? Hey. Don’t discount Canada: last time we were in a war with them they burned down our White House!

Coal Liquefaction

When pressed, societies have in the past resorted to synthesizing gasoline out of coal, in a method known as the Fischer-Tropsch (F-T) process. Coal, which is mostly carbon, is partially combusted, or “gasified,” to make carbon monoxide. The CO is combined with hydrogen gas to make long-chain alkanes like octane, spitting the oxygen out in the form of water. One typically uses CO also to create the hydrogen gas from water via CO + H2O → H2 + CO2. Thus only one of every two carbon atoms winds up in the synthetic fuel, the other lost to CO2.

The National Mining Association, strongly advocating our using more coal as fast as we can, estimates a refinery cost pushing $1B, yielding 10,000 bpd production. For scale, a 3% per year conventional oil decline would leave the U.S. short by 600,000 barrels per day, requiring 60 such new plants to be built every year to plug the gap—each costing about the same as a 1 GW coal-fired plant (and processing 0.6 GW-worth of liquid fuel energy per day). It’s a big deal. Obviously, I’m not suggesting that coal liquefaction—or any of these alternatives—carry the full weight of replacement, but simply use full-scale numbers to establish the bounds and set the scale.

Compounding the problem of the required rate at which new processing plants would have to be built, consider the numerous downsides of coal. We would desperately like to shake our addiction to the dirtiest, most CO2-intense fossil fuel. How’s that workin’ out for us? Mountaintops razed flat, mine tailings, sulfur, mercury, and other toxins leaching into streams and rivers: expanding coal production is not high on the list of things we want to do.

We should also be careful about assuming that we are up to our ears in coal. It’s true that the U.S. has ample coal resources compared to its remaining oil endowment. But consider that the estimated total U.S. resource has declined from about 3000 Gt (gigatons) prior to 1950 to half that amount around 1960, lately sitting around 300 Gt. This isn’t due to depletion of the resource (70 Gt so far), as the number I’m quoting is total resource: past production plus estimated resource.

A similar story unfolded in the UK—whose leading role in the industrial revolution owed to vast amounts of coal in the ground. For over fifty years leading up to 1970, British coal was repeatedly estimated to total about 200 Gt. Over the next few decades, the estimates collapsed to about 30 Gt. The biggest shock is that this happened when 25 Gt had already been consumed, suddenly leaving about 5 Gt of recoverable coal when it had been imagined to be about 170 Gt. Imagine you’ve got $17,000 in the bank and you are contemplating buying a new car—only to realize that your latest bank statement puts you at $500: 3% of what you thought you had, and maybe not enough to even buy a old beater that still runs. As we’ve learned more about what kind of coal seams are accessible, downgrading estimates has been a global systematic phenomenon. Many folks, unfortunately, still carry around the old concept that we’ve got more coal than we could possibly know how to use (to the chagrin of the climate-concerned).

To date, the U.S. has used 70 Gt of coal, at a current rate of about 1 Gt/yr. If the current official estimates are right, then we have about 230 Gt left. Simple math suggests this means 230 years, or 86 years at a 2% annual increase. But other compelling evidence put together by David Rutledge suggests that we are now about halfway through the resource, having only 60 Gt left. The same analysis puts remaining global coal at 370 Gt, having used about 310 Gt to date. This estimate of remaining global coal is a little less than half of conventional estimates. I’m not prepared to judge which estimate is correct, but take seriously the possibility that we have much less coal than is assumed—especially in light of the dramatic trend of reduced resource estimates over the decades. If you’re going to err, it’s best to err on the safe side.

How do these numbers translate into oil production? One kilogram of coal, containing perhaps 0.7 kg of carbon, via Fischer-Tropsch, will commit 0.35 kg of carbon to about 0.4 kg of octane (C8H18), producing about 0.6 liters of fuel. One barrel (160 ℓ) of fuel then requires about 250 kg of coal, leading to the association that each ton of coal yields 4 barrels of fuel. Replacing a 3% shortfall of about 200 million barrels per year in the U.S. requires an annual uptick in coal production of 50 Mt/yr, or a 5% increase, year over year, for a doubling time of 14 years. In a related measure, if the U.S. wanted to (or were forced to) cease oil imports, it would mean doubling coal production, giving the U.S. perhaps as little as 30 years of resource.

Could we imagine ramping up coal production at anything approximating this scale? Again, it could certainly contribute to easing the decline, but is likely incapable of carrying the load on its own—if we would even want it to do so, given the many downsides of coal. We are presently striving to use less, not more.

Gas to Liquids

As with coal, methane gas can be synthesized into liquids like octane via the Fischer-Tropsch method. In this case, steam is mixed with methane (CH4) to produce CO and hydrogen gas. Then the CO is combined with hydrogen in the usual F-T dance. This time, all the carbon goes into the fuel since the necessary hydrogen is provided by methane, and is therefore a more efficient process. In either the coal or natural gas route, all the carbon ends up in the atmosphere after combustion anyway (unless one of the carbons is captured in the coal version), so no big difference there.

The U.S. uses about 20 tcf of natural gas per year, where a tcf is a trillion cubic feet. One cubic foot is 28 liters, and at 16 grams per mole, 22.4 liters per mole at standard temperature/pressure, methane has a density of 0.7 g/ℓ. Each liter of methane can create 0.64 g of octane, so that a liter of octane (at 700 grams) requires 1100 liters of natural gas. Replacing a 3% annual shortfall of 200 million barrels (at 160 ℓ/bbl) would then require 35 trillion liters of methane, or 1.2 tcf: a 6% annual increase in natural gas production—similar to the impact on coal. This isn’t too surprising since we currently get comparable amounts of net energy from gas and coal, and each being roughly half what we get from oil. So a 3% decline in energy from oil would need to be replaced by something like a 6% uptick in either replacement.

Estimates of how much natural gas is available is all over the map. Conventional natural gas development is in decline in the U.S., but a recent surge in hydraulic fracturing (fracking) has many folks giddy over the prospect of a seemingly inexhaustible resource. But beware of the low-hanging fruit phenomenon. If we base our enthusiasm on the earliest, easiest to exploit examples (akin to gushers in the early days of oil), we may find ourselves disappointed. See the illuminating report by David Hughes for a more sober assessment of our likely natural gas resource.

For example, the U.S. Energy Information Agency projects that shale gas—currently at about 15% of domestic gas production— will nearly triple by 2035 to be our single biggest resource for natural gas. This is on top of a conventional supply that falls by 29% over the same period. In aggregate, the rapid expansion of shale gas allows a slow net growth rate of 0.4% per year. The faith in shale gas to deliver already seems stretched a bit, so that it is difficult to assess the likelihood of net gas production growth at all. And even if it does grow, the 0.4% per year projection falls far short of the 6% level that would be needed to offset a 3% per year decline in oil.

Where Does this Leave Us?

We built this world on fossil fuels. It is distressing to realize that our primary fuels will begin an inexorable decline this century. The result is that we will have difficulty even maintaining our current energy expenditure rate—let alone continuing our historical 3% annual energy growth rate. A major adjustment is in the offing. Economic growth, look out!

Yes, we can re-purpose other fossil fuels (coal, gas, heavy oil/tar) to help plug the gap in liquid fuels, meanwhile accelerating their depletion. We can use liquid fuels more efficiently. We can try every trick to tease more oil out of depleted wells. All these things will happen. Their collective effort will ease the pain (and bring on new hurts), but it is not clear whether all efforts in tandem can arrest the decline, given practical, political, end economic realities. They are all more expensive, all lower EROEI, all harder, and with the exception of efficiency improvements keep pumping CO2 into the atmosphere. Although the pain may be eased, the problem does not go away. I’ve never had a hangover, but I imagine this is what such an existence would feel like: a fossil fuel hangover. When will we decide to pull the plug?

My cynical prediction is that concerns over climate change are unlikely to hold sway over energy scarcity. Heck, climate change has had little influence over our current energy mix even when energy is cheap and abundant. In some sense, this track record only highlights the difficulty we have in finding suitable alternatives to fossil fuels. Maybe declining fossil fuels will provide the impetus that climate change has not succeeded in delivering: for us to finally embark in earnest in a deliberate departure from our old friends.

But we may decide instead to cling to the lowborn cousins of the royal fossil fuels: the kings of old. No matter what mix we decide to pursue, if we wait until the decline starts before seriously ramping up all viable efforts in tandem, we will find economic hardship, job loss, energy volatility as demand flags and then resurges, etc. The unpredictable environment will not be conducive to large investments in risky alternatives. In short, we could get caught with our pants down. And if you’ve ever tried to run in this state, you know what happens next.

So I don’t look at the hydrocarbon resource figure above and feel cause to breathe (cough?) a sigh of relief. If we’re going to try following that route, though, we’d best hold our noses and get on with it. Failing this, an advisable strategy is to start transforming our personal lives to be less dependent on energy—because then we’ll be less disappointed with failure and skyrocketing energy prices when that comes.

Subscribe to receive e-mail notices of new posts (info absolutely not shared!).

Views: 101478

I have heard speculation one of the key reasons the Nazis lost the war–other than Yankee gumption, of course–was that coal liquefaction is actually energy negative.

I doubt this rumor. A quick search turns up numbers in the 5 to 8 range, which seems entirely plausible to me. But I have not gone through numbers myself.

5 to 8 what? EROEI? Getting 5 Joules per one joule of coal seems rather unlikely. Converting 5 Joules of coal to 5 Joules of oil per 1 Joule of coal for work would still seem unlikely, though make more sense.

EROEI of 5:1 means you can capture/transform 5 units of energy for the investment of one unit to carry out said transformation. For instance, at 5:1, to deliver 5 Joules of liquid energy, one must expend 1 Joule of energy to affect the conversion. If that one unit comes from the unprocessed resource itself, it means you have to dig 6 Joules out of the ground, using one of those to produce 5 units of the alternative form. Nothing comes for free, but viable energy resources deliver more energy to the user than it took to extract or process that energy.

I think the Peak Oil blogosphere makes EROI seem a lot more important than it is, at least so far. Going from 100:1 to 5:1 sounds like a huge change. But think of it this way: in order to get 100 barrels of oil in energy, you’d have to drill 101 at a 100:1 EROI, or 120 at a 5:1 ratio. So it’s only a ~20% increase in oil usage.

It’ll really become significant if we continue to decrease the EROI of our fuel sources, but for now it shouldn’t make much difference.

Those numbers feel wrong, Charles. Try another angle: at 100:1 you need to burn one barrel of oil, and you get 100 back. At 5:1, you need to burn 20 barrels of oil to get 100 back. You need 20x the investment, or, correspondingly, just getting the energy is taking 20% of your economy instead of 1%.

I suppose another angle is that 5:1 is still profit of 400%, which compared to normal business profit margins is wheee insane.

I like the first angle better. In the second angle, imagine that energy profit is 10%, like business. It would mean that we would have to ramp up energy production ten-fold over today’s level just to have the same amount available. Having a hard enough time keeping up now, that prospect elicits no “wheee” from me.

If EROI is defined as Eout/Ein, and Enet=Eout-Ein, then at 100:1 ratio you’d need to invest 1.01 barrels’ worth of energy to procure 100 barrels. At 5:1, you need to expend 25 barrels’ worth of energy to procure 100 barrels. So EROI as defined *is* significant- and below 5:1, it has been hypothesized that you are well over what is described as the Energy Cliff: http://www.theoildrum.com/node/8625

I’m only an amateur at WW2 history, but I doubt that speculation very much. The timing is all wrong. Nazi Germany had already lost the battle of Stalingrad and was in full scale retreat before Germany had its supplies of oil cut off.

Oil shortages for Nazi Germany did not become acute until late 1944 after they had lost access to the Plotski oil fields, and their syncrude plants were bombed. By that point they had already lost anyway.

The German syncrude program performed adequately and supplied 36 million barrels of oil per day, which was over half their oil requirements. Syncrude alone was enough to avoid acute oil shortages. Nazi Germany did not face severe shortages of oil until after the syncrude plants were bombed.

What would “energy negative” even mean, here?

Say you start with 100 Joules of coal and a bunch of water. It’d be nice to have magic catalysts you wave them over that produce 100 J of oil. But realistically I’d expect to use up some of the energy in the coal to drive the process, producing 33 Joules of oil, or 50, or 60. Converting one form of energy to another more convenient will usually take work. But what’s negative? What *can* go negative?

In principle, it can take more energy to convert a resource than the converted resource can deliver, and I’m guessing this is what Ruben means. For instance, corn ethanol flirts with energy negative. By the time you add all the energy used to plant, fertilize, water, harvest, process, ferment, etc., the resulting liquid fuel may offer less energy than what went into bringing it about. Such “resources” would constitute a net energy drain. Sometimes this might be warranted, if form A is hard to come by any other way, and you can invest 2 units of abundant energy form B to make one unit of rare form A, the “negative” energy return may still be worthwhile. But on the whole, I tend to dislike resources with EROEI less than 5:1.

With corn, the fear is that we’re spending a gallon of oil to make a gallon of ethanol meant to replace a gallon of oil (ignoring constant factors.) So it’s supposed to be green, but isn’t, because we’re using just as much oil. Also corn’s supposed to be bringing solar energy into the system, and it’s disturbing if that contribution seems swamped. (Actually the fertilizer is probably coming from natural gas, not oil, but we could probably convert gas to oil more efficiently than by going through corn.)

Coal to oil is a pure conversion, like converting heat to electricity, and absent hard data I’ve always assumed similarly lossy conversion (and even more so for synthesis from atmosphere.) So, expensive, but the sort of thing you do if you need liquid fuels for flight and shipping. The whole point being, yes, to convert abundant coal or gas (or biomass, or atmospheric CO2) into rare but useful oil.

If you tried to use corn ethanol instead of petroleum to run the machinery and processing—so it is a closed system—then an EROEI of 1.2:1 would mean that for every 12 gallons coming off the field, you’d put 10 back in. So you only keep 16% of the product. If the EROEI is 0.9:1, there is no way it could be self-supported in this way. So the fear with corn is not just that it’s a fossil fuel sink, but that without fossil fuels it may not be able to support itself as a true source of liquid fuel.

With coal, you get roughly half a BTU of liquid fuels out per BTU of coal input. So that means around half a BTU consumed to produce half a BTU, or an EROEI of about 1. But, this is where economics can trump EROEI (at least in the short term). Coal is cheap and liquid fuels are not.

Fantastic article by the way. You hit upon so many of the topics that I think are so important for people to understand.

Robert Rapier

Thanks, Robert. I assume that the 5:1 EROEI estimates for CTL are counting external energy inputs, not from the coal itself (I should really investigate). But you are right that if you count the coal energy that does not end up in liquid, by your numbers, the EROEI is down in the dirt.

If you think about it, though, one shouldn’t do an EROEI accounting of just external energy inputs. If I accounted for EROEI in that way, I could in theory derive 100% of my energy requirements from the BTUs contained in the coal, and thus have an EROEI of infinity. I can do the same for oil refining. I could either use external energy to fuel the refining process and get an EROEI of 10, or use fuel gas produced from the oil itself and get infinity — for the same process. By counting actual energy consumed — whether external or internal — the EROEI is consistent.

RR

Agreed: external inputs alone can mask the true energy cost. In the case of CTL, just because we use only one out of every two carbon atoms does not necessarily mean that we forgo half the available energy, in a weird way. A gram of octane has roughly double the energy of a gram of coal. In the post, I determined that it takes 250 kg of coal to make a barrel of oil (112 kg of octane, actually). At 6 kcal/g vs. 11 kcal/g for coal and octane, respectively, I get to keep 82% of the energy content. The hydrogen bonds, absent in coal, largely make up for the lost opportunity in carbon. On the face of it, getting one unit of liquid fuel energy while forgoing 0.18 units looks like an EROEI close to 5:1 for CTL.

I would have to dig deeper to find out how much energy is actually required, counting external inputs vs. that used from the partial combustion of coal to CO, etc. But EROEI takes on a new twist if one talks about potential energy that is forgone (even if not used) in the process of a conversion.

WW2 was essentially the first major resource war. The Germans and the Japanese had military economies that could only function by thrusting out to take resources from other less powerful nations. The Japanese had to take the oilfields of Indonesia, the Germans the food producing areas of eastern Europe and the oilfields of Romania and the Caspian and if possible the Middle East.

The Americans had their oil (and other raw materials) within their own territory, and in vastly greater amounts.

It therefore became a direct contest to see who ran out of gas first.

If on the other hand the Germans had harnessed the energy of the atomic bomb , that would have reversed the course of the war (they were close to having the means to deliver it to the USA). The UK would have been nuked back into the stone age. As it transpired, the UK became effectively an aircraft carrier from which to bomb and invade occupied Europe.

This strikes me as oversimplistic. I don’t think Germany *needed* to steal food producing regions. And I’ve never heard that it was a matter of Germany running out of gas. John Keegan wrote that before the war, world industrial output was partially distributed as such:

Japan 7%

USSR 14%

Germany 14%

UK 14%

USA 42%

Plausibility can be checked against relative populations and development levels. Never mind energy; US and UK alone were together making more than half of the world’s stuff; USSR brings that up to 70%. The Axis was outgunner from the start, or more accurately, out-factoried. Japan was challenging a nation 6x its power.

“… we will find economic hardship, job loss, energy volatility as demand flags and then resurges, etc. The unpredictable environment will not be conducive to large investments in risky alternatives.”

Tom,

First of all I’d like to thank you for your devoted efforts towards producing such an excellent information resource. Well done sir.

Regarding the quote above – sounds a lot like current events…

There’s a second climate-related economic problem. A huge chunk of our current economy’s valuation (the fossil fuel industry part) is based on the assumption that we will extract and burn all the reserves. http://capitalinstitute.org/blog/big-choice-0 If we declared a credible world-wide carbon budget (if pigs had wings), pffft!, there goes the valuation of all the oil and coal companies.

In the short run, I’d bet on increased carpooling when prices start to pinch. I recall that there was a fair amount of that during the 1970s, and improvements in GPS and smart phones and social networking ought to make it easier to find riders or rides. The flip side of this is that it makes fossil fuels that much more valuable, since we would extract double or triple the people-transportation from a gallon of gasoline, so we would probably continue to extract them.

Once again, that was a very interesting read.

In most of the US, it’s basically impossible to survive without a car.

It’s also the case in some parts of Europe, but less so.

I live in a medium-sized city in Germany, and I can go everywhere I need by walking or taking the tramway. I don’t own a car, and the last time I needed one was to move out.

How on earth do you tell millions (billions?) of people that their house is in the wrong place, that the urban area around them is totally inadequate without cheap oil and that they should have thought about this problem before because they cannot go to work any more, cannot go shopping either and cannot grow their own food?

I find it really hard not to think that we’re completely screwed when I think about global warming, energy scarcity and our present frivolity.

I don’t think it’s quite that bad, but I view this from the perspective of someone who grew up in Florida (to which millions of people moved, decade after decade after decade) and who gets around quite a lot on a bicycle. If you look at things with a “car eye”, it’s “impossible” to get by without a car. If you look at things after spending some years doing a lot of commuting and errands on a bike it’s not necessarily so bad.

Except for work commuting, you can “fix” a lot just by changing land use. Shopping and services are easier to move than all their customers. There’s a size/distance/cost tradeoff to made here, I assume we will sort it out by the usual market mechanisms, if zoning can be changed to allow it.

The primary obstacle to not driving cars, is other cars on the road. Dense cities in the US still have plenty of car use, and it’s because of the perceived relative safety of using cars. There are low-energy options that we don’t use here in the US because they would be (or seem) unsafe in the presence of automobiles. Bicycles and electric scooters are two of these. Where I grew up (Gulf Coast Florida) is a prime example of this; shops and services are actually distributed relatively close to all the people (it’s wall-to-wall people), but all the routes there are filled with cars, some moving very fast. So you drive. Reallocate that pavement, you might make not-cars more attractive.

There’s a range of low-energy options. If someone says “bicycle”, that’s not just a bent-over-hard-saddled-skinny-tired racing bike; it could be a cargo bike, or a velomobile, or something with electric assist. An electric scooter can give you more speed to let you handle a longer commute.

There will be carpooling to work. (see comment above).

Some fraction of people will just need to move. But people have moved in the past for economic reasons, so they will again.

On the other hand, I’m contemplating changes to zoning, changes to road use, lots more physical effort and exposure to the weather, and sharing your car with Other People. Maybe some people view that as the End Times.

Well, if you don’t tell them anything, the price of gasoline goes up and speaks for itself. States or countries with wise governments and people that can listen to them can work on adjusting en masse. Those with foolish governments or populaces that won’t listen will go down struggling.

Note the former isn’t mythical. Japan’s a poster child for a government that can tell it’s people to jump, but Germany’s been racing to renewables as a matter of policy, Nicaragua was in the news recently for wanting to go renewable, a friend in Chile claims Chile has a 20 year plan to get off oil. Don’t know the reason, but most of Europe if not the world has high gasoline taxes, so less sprawl and built in financial buffer.

And, as with cell phones, countries that never got around to developing the old oil-based infrastructure won’t have the sunk costs telling them not to develop renewables. Solar power that looks expensive to us can be “woo! electricity!” to an African village that hasn’t had any. The oil addicted will be left behind, the world will move on.

In the short term, for getting to and from those houses, municipalities might find it worthwhile to pay the price for frequent buses or light rail, even if they’re not optimal for the space distribution. I estimated that the US could have pretty decent transit buses all over its roads for less than we spend on new cars every year.

We can definitely survive after peak oil.

Bear in mind that 80% of car trips at present are discretionary and could be sacrificed; only 20% of trips are travelling to/from work. In addition, we drive 25 mpg cars at present when 200+ mpg cars are technologically available now, using little tandem-seating ultralights like the Volkswagen 1L. In other words, we could reduce our oil consumption by 95+% fairly quickly without severe disruption because most oil is WASTED.

Similarly with transport of goods. We waste oil now because oil is cheap. We could easily electrify train routes, and use trains more and trucks less, and possibly even use trolley-trucks etc.

Bear in mind that the economy allocates resources to their most important uses as a consequence of the price mechanism and of basic asset allocation decisions. As a result, the economy would not sacrifice essential functions unless oil supplies declined by 80% and did so more quickly than we could transition to alternatives. Since the economy already turns over the fleet of cars, and already transitions between energy sources, far faster than any plausible rate of oil decline, we do not face a disruption to civilization.

Peak oil may cause unwelcome changes to the American lifestyle. We may have to drive little tandem-seating ultralight cars in the future when we’d prefer to drive SUVs. We may also face a recession, because people who’d recently bought SUVs need to curtail their consumption all of the sudden.

We do not, however, face any disruption to industrial civilization. It is well within the capacity of the economy to transition faster than oil declines. Even a 90% reduction of oil supplies within 30 years would not cause anything like the industrial collapse posited by Kunstler etc.

Or course peak oil could provoke a war that engulfs all the major powers and ruins everything. There is no way to predict this. Such a war could even happen without peak oil. However there is nothing inevitable about it.

“Bear in mind that the economy allocates resources to their most important uses as a consequence of the price mechanism and of basic asset allocation decisions.”

I’m not so sure in the case of oil. In a truly efficient economy, we’d have a small human population and an effectively limitless supply of fossil energy (because we’d be continually finding new and more interesting ways to live our lives while using even less of the earth’s finite resources than before).

Instead we have a global industrial economy that’s designed to use as much energy as possible, via exponential growth in population and demand for energy-using stuff and activities (including making solar panels and hydrogen) Winding down any part of the waste economy (especially the car industry, which is the gold foil on the cherry on top of the icing on the waste cake) shuts off power needed by the energy waste/debt finance structure, including the power to fund alternatives to wasting energy.

Look at what’s happening in Europe. The German money-engine is cooling down as it adapts to low-density, less waste-friendly renewable energy inputs. Follow Italy’s increasing inability to pay for sufficient oil imports to maintain its waste-economy now that Germany is quietly getting itself out of the waste game – and therefore isn’t generating the shedloads of spare fossileuros that Italy and others need to borrow to fund their own ‘insufficiently developed’ waste machines.

Bottom line: you can’t keep a waste-based society alive by making it more efficient. Be ironic if Germany ended up being invaded by other countries seeking to tear down its solar panels in the name of ‘energieverschwendungraum’ (energy-wasting space).

Do you we have the technology to have electrified train routes and high mpg cars? Absolutely. But, if the price of oil doubled/tripled tomorrow how long would it take to build a fleet of these high mpg cars? Years? Decades?

And building a fleet of cars is cake compared to building a brand new electrified train system for the whole country. We are talking 5,000+ miles of train to be even remotely useful in replacing long distance trucks. That would just be Florida –> New York and East Coast –> West Coast.

Then there is the problem of the energy trap that Tom wrote about a few articles ago. I wish I shared your optimism…

“But, if the price of oil doubled/tripled tomorrow how long would it take to build a fleet of these high mpg cars? Years? Decades?”

It would probably take 2 decades or so. That is fast enough, since oil will not be exhausted in 2 decades. There will still be significant (although reduced) oil production even 100 years from now, barring a war that destroys us all.

Remember that it’s not necessary to complete the transition to alternatives before the oil decline begins. Instead, it’s only necessary to transition to alternatives fast enough to offset declines _as they occur_. Thus, we would only need to replace about 2% of our truck traffic with electric rail traffic, per year, to offset declines, without _any_ reduction in cargo transported. I’m sure that 2% per year is an achievable figure. Bear in mind that we built the entire interstate highway system in 20 years or so.

I look forward to my Government building these high mpg cars and issuing one to me when my turn comes!

Because if the price of oil doubled tomorrow the economy here in the UK and in the other OECD countries would crack within weeks, and me and 40-odd million other potential car buyers would be lucky to be able to afford puncture repair kits for our bicycles ever again, let alone new cars.

As it happens, the UK has been replacing about 5% of its car fleet each year, and the last five or six years have seen a 20% improvement in the average official mpg of new cars.

Theoretically, the most of the UK car fleet could turn over in the next 12-14 years, with even the 12-year-old cars being capable of 55-65mpg (imperial gallons) in 2025.

However, UK new car sales are declining due to falling real incomes and scarcity of credit (although they appear to be in rude health compared to markets like France and Spain). It will need a very pronounced turnaround in the economy to return to restore the car market to equilibrium, let alone growth.

I can’t see that happening for several years. By which time we’ll be reaching the point where very little liquid fossil fuel is reaching export markets, pulling the curtain down on the era of mass motoring in the customer countries.

It is interesting how much optimism has been expressed in this thread.

Unfortunately, I’m not sure that such optimism is warranted given the scale and complexity of the predicament.

One of the things I like most about “Do the Math” is that through estimation, Tom has been able to provide a sense of scale and plumb the depths of some of this complexity – not something that is otherwise easily done.

I think it behooves us all to stop hand waving and take seriously the risk of civilizational collapse. It seems highly probable that we have already reached a point in time where all-out effort at mitigation may not be sufficient to prevent severe discomfort in the not-so-distant future.

Technically, there is ample reason for optimism. The supply side looks iffy, but the demand side here in the US has tons of waste that could easily be trimmed, and trimmed in a hurry if we were motivated.

So for example, I know how to double or triple the pmpg of a car overnight — carpool, the next morning. No challenging research problems, no gloomy thermodynamics — just use your car the way it was intended, with peoples’ butts filling all the seats. There’s at least one startup (Avego) pushing iPhone apps to make this easier.

Or, how about your diet? A big chunk of our energy goes into the production of food to grow meat. Eat less meat (beef, pork, lamb, deep-sea fish, and go easy on the chicken), save energy. No research necessary — again, this energy-saving measure can be deployed overnight.

Or, how about bicycles? Even drinking 1% milk for transport fuel, the end-to-end efficiency (including the energy required to grow the feed for the cow that produces the milk), a human gets the equivalent of 150mpg. Potatoes, about 780mpg. Oatmeal, as much as 3000mpg. Depending on where you live, and the bike that you already own, you might be able to replace auto trips with bike trips, starting tomorrow morning (roughly 1/3 of the US population lives in places as dense or denser than Assen, a Dutch town with 40% bicycle ride share).

You could adjust your thermostat, especially in the winter, and dress a little warmer indoors. Further research needed? I don’t think so.

There’s reasons all this boring demand-side stuff doesn’t get so much press. First, we don’t like change, and we’ll happily engage our own internal BS generator to spew out excuses for why we cannot possibly do X, or Y, or Z — or, we’ll watch/listen to the advertiser-supported talking heads who will tell us soothing (?) tales about how unAmerican it would be to change. Second, nobody is going to make terribly much money from demand-side reduction; if anything, big established industries would see their revenues cut. Third, there’s not too many exciting research problems to solve; it’s really cool to be the guy who develops the breakthrough battery/algae/solar cell, but where’s the fame in telling people to eat less meat, ride their bikes more, and carpool for long-haul travel? That’s not going to get anyone tenure.

So technically, optimistic, socially, not so sure, but the only way to make progress on the social side, is to keep pointing out that yes, we could do it.

You’re beating me to my upcoming themes in Do the Math! Good work!

“I think it behooves us all to stop hand waving and take seriously the risk of civilizational collapse.”

I don’t see any examples of people arguing against collapse who are “hand waving”.

If anything, it’s the peak oil doom movement which engages in hand waving. The peak oil movement has made a long series of drastically wrong predictions, usually in a tone of total certainty. Now they have forgotten about their prior failed predictions. I think that is the ultimate act of hand waving.

“Unfortunately, I’m not sure that such optimism is warranted given the scale and complexity of the predicament.”

It’s not just the scale of the predicament, but also the scale of our resources. For example, how quickly could we build electrified rail lines? Is it within our industrial capacity? Could we build them fast enough to offset the declines of oil?

It means nothing just to point out the scale of our problems. The question is whether they are larger than the scale of our solutions.

Every country with hundreds of millions of people faces a massive number of problems every day. For example, we must build an entirely new fleet of 100 million (!!) cars in this country during the next 15 years, even without peak oil. Anything done on a national scale will seem enormous compared to the individual.

Tom S.

It’s always fun when someone takes the time to itemise how many times Daniel Yergin has been totally wrong with his cornucopian, ‘anti peak oil’ predictions.

Would you care to itemise a similar list of drastically wrong peak oil predictions?

After all, we do seem to be on an undulating plateau for all liquids, despite the huge hike in oil prices. Even the IEA has now called peak conventional crude. The NGLs and stuff that make up the numbers deliver less energy per barrel, so the declining net energy thing is visibly happening.

“For example, we must build an entirely new fleet of 100 million (!!) cars in this country during the next 15 years, even without peak oil.”

The ‘must’ is a cracker!

Something that I find a bit off-putting about the Brandt&Farrell graph is that their cost estimates for the remaining liquid fossil fuels are based on current extraction prices. There seems to be no incorporation of the idea that the fewer reserves are available, the more difficult and expensive fuel extraction tends to be. For instance, for conventional oil, “High estimate is from Energy Information Administration (2005), and is the sum of finding and lifting costs reported for “worldwide”. Low estimate combines a lower estimate for development costs for Middle East producers (Stauffer 1994) combined with the lifting costs for the Middle East from Energy Information Administration (2005).”

I agree. I totally ignore the vertical axis. The cost of extraction tends to float up as energy is more costly. At the very least, their lines should slope upwards, as the tail end of the resource is always more costly to extract than the early stuff. I added these sentiments to the post: should have thought to do it straight away.

I don’t think we should totally ignore the vertical axis – the *relative* cost differences are what really count.

CtL will always be more expensive than GtL which is more expensive than oilsands etc.

The fact that oilsands are being done, and expanded today, with oil at $100/bbl, and GtL is not (Shell has just completed the first large scale one, and has now plans for any more) suggests that the GtL price is at least $100/bbl, and CtL more than that.

The cheap oil is running out fast…

The best part is, even if we moved all cars, pickups and SUVs over to pure electric, AND never used oil to make electricity, how long would all the oil in the world still last if it was used only to make Diesel (for trains, semis, cargo ships) and Jet Fuel? You know those things that allow us to move products around the world and have this commerce system.

Forget about how you get to work, how does food & stuff get to you? Does the world revert to 1812, maybe an electrified 1812? This is what I worry about in the next 30-40 years.

http://www.eia.gov/dnav/pet/pet_cons_psup_dc_nus_mbbl_a.htm

US production is 3 billion barrels per year gasoline, 1.4 billion barrels diesel (distillate), 0.5 billion barrels jet fuel, 0.2 billion residual fuel oil (bunker, what big ships use). Asphalt and feedstocks are another 0.5, if that. Total production is 6 billion barrels. So if you cut cars out, you potentially double production. Of course, oil naturally comes in various fractions, best suited for various uses; OTOH, it’s also convertible with work.

http://www.eia.gov/dnav/pet/pet_sum_sndw_dcus_nus_w.htm has consumption not production, and more recent, but similar story. 8.6 million barrels/day gasoline, 1.4 jet, 4.5 diesel, 0.5 bunker.

Diesel (distillate fuel oil) also includes heating uses, which are substitutable. Trucks can also be replaced or electrified, with infrastructure, and of course diesel trains can be — someone said their transmissions are already electric, using the diesel engine as a generator.

Jet + shipping + industrial is 1.2 out of 6, so quintuple the time. Or 1/5 the production capacity needed, if we synthesized liquid fuel from other sources.

I’m ready. This weaning will be harder for governments, and government departments such as the U.S. Department of Energy, because fossil fuel users subsidize them.

You say:

“This time, all the carbon goes into the fuel since the necessary hydrogen is provided by methane, and is therefore a more efficient process. In either the coal or natural gas route, all the carbon ends up in the atmosphere after combustion anyway (unless one of the carbons is captured in the coal version), so no big difference there.”

Am I missing something — surely this is an error? If all the carbon from natural gas goes into the synfuel, then surely this is a more efficient process than CTL? All the carbon may eventually end up in the atmosphere, yes, but with CTL a large proportion does so a the synthesis stage, whereas with GTL this is occurring at the consumption stage (naively implying more bang-for-buck)

I mused about this too: how can CTL do as well as GTL if CTL gives up one of the carbon atoms? I think the answer is that methane is hydrogen-rich, so that some of the chemical potential energy residing in methane does not end up being utilized in octane. Perhaps the excess hydrogen can be used for energy separately. But as far as the liquid fuel goes, CTL gives up some carbon while GTL gives up some hydrogen, making it roughly a wash.

Good point. What if we redefine efficiency to mean “energy yield per unit of greenhouse gas emitted? Hydrogen (AFAIK) has no effect there…

[editor note: this post is longer than is ideal; please try to keep short]

Great summary. But I want to address the idea that in order to be sustainable and low-energy we must accept wimpy cars. This may be the case with pure ICE’s but not for EV’s. This is a myth perpetrated by the Neighbourhood Electric Vehicle / golf cart problem (it takes a big investment to get a car tested and certified for the highway and since no major automaker was previously willing to do this, all previous EV’s were legally mandated to be wimps and top out at 40 km/hr — reinforcing the public perception). I harp on this because it is a major barrier to the widespread uptake of EV’s by the public.

Now, the most fuel efficient car in the world (Tesla Roadster) is ALSO one of the fastest street legal cars in existence! My friends drive my Leaf and they are amazed. This is because the energetics are fundamentally different for an EV than an ICE. A powerful ICE sucks gas all the time regardless of whether you need it (unless they use complicated cylinder disabling features). This is not true for an EV.

I don’t know what percentage of the cars sold nowadays are hybrids, I’d guess maybe 10%. There is no fundamental reason why they could not all be plugins, and right there that could solve a huge part of the scale issue in converting over to electrification. I don’t agree with Hirsch’s dismissal of EV’s. If we are facing energy shortages, we only have certain options available to pursue. Pulling energy out of all these poorer quality sources described in the article is one option, but then that leaves us with nothing at the end if we don’t also change our consumption infrastructure. Instead devoting that effort to electrifying the automotive fleet is another option to spend our efforts. I say we do both.

Let’s say for the sake of argument that there were enough fossil fuels left to convert the remaining vehicle fleet over to electric and to provide every household with rooftop of solar panels. In the summer there is no reason why those households could not enjoy the same energy consumption they do now, and drive cars even better than what they currently drive.

Of course, getting to that stage is the challenge, but if we still have half our FF’s remaining (I am skeptical of this for reasons explained in the article) then the hurdles to this transition are largely political, not technical.

I don’t disagree on principle. The wimpy statement is simple: freeway driving is dominated by air resistance. If you want to spend less energy getting around, no choice but some combination of slowing down in a smaller, more streamlined car.

If you have plenty of excess energy from renewables (I dream of this day), then sure: go nuts with high performance EVs.

If you took a normal Prius and added plug-in capability (with stock battery at less than 2 kWh), you’d get a range of maybe 5 km (3 miles). So just plugging in our hybrids without major battery upgrade is not nearly enough.

Then there’s price. Tesla may be high performance, but also high price tag. I looked at the Volt for myself, but shied away from the price.

I would love EV’s to break our into a viable mass solution (would open the gates for solar, for instance), but I’m less than convinced this will happen to my satisfaction.

Further to Tom’s point, my wife’s electric bike has about 0.36 kWh storage in its battery, has a range of about 50 km (30 miles). In other words, it’s more than 50x as efficient.

It has a cruising speed, without pedalling, of about 35 km/h (~20 mi/h).

There are a lot of size/power graduations between a bike and a car that offer huge efficiency gains.

Regarding a car’s performance, include the time you spend working to pay for it and its performance doesn’t look so rosy — especially if you factor in real-world factors (like red lights, finding a car park, and gridlock)

Then they’d only have to increase the Prius battery size by like 4 times or something to give it a 20 km range, not too tall an order. This is actually what Toyota is doing I believe, they are bringing out their plugin version this year? This should only legitimately increase the car’s price by $1000 or so (realistically, they’ll probably charge more).

So then with a 20 km e-range you could dive to work on electric, charge it at work, and drive home on electric. Most trips are short.

I have a feeling that once mass production ramps up, EV’s will cost no more than equivalent ICE cars, maybe even less due to their simplicity. Of course, as oil becomes scarce, costs of ALL manufactured items will go up.

It’s true what you say, you really get a feel for energy efficiency when having to do a long drive in an EV. 50-60 km/hr is ideal. Highway driving forces you up to 80 or 90 which kills range.

*km*/hour? US highway speed limit is usually 65 *miles* per hour, or 105 km/hour. 50-60 km/hour would seem horribly slow.

And with high speed rail in the range of 300 km/hour, all that effort into EVs might seem rather mis-apportioned.

Damien, the point of a plug-in hybrid isn’t to be useful on a 65 mph freeway – the vast majority of trips are much shorter and never touch a superhighway. We’re talking about the 10 mile round-trip to a grocery store on 35 to 45-mph surface streets.

High-speed rail and EVs are not mutually exclusive – to the contrary, they are mutually beneficial. You cannot build HSR stations on every block, but you can conceivably put an HSR station within EV range of every major population center.

This is in response to Travis’s comment.

A big issue with EVs and plug-in hybrids is cost-benefit to the purchaser. Here in the UK, someone of average means might reasonably justify spending £10,000 on a new ICE with go-anywhere, use-anytime capability, and a 500-mile range at 55mpg (imperial). A plug-in hybrid is more expensive because it is more complex (two powertrains). In practice, EVs and plug-ins are currently 2 to 2.5 times the price of an average ICE.

It’s often argued that the cost of EVs and HEVs will fall as sales volumes rise – but why should sales increase greatly? These cars don’t do what ‘ordinary’ people want cars to do – which is provide carefree, long distance journeys.

The argument that high oil prices will force people to buy EVs doesn’t necessarily hold. High oil prices are just as likely to force average earners to do what they did before the East Texas oilfield was discovered in 1902 – not own cars at all.

Fiat’s boss said last week that his company needs to get out of making small (that is ‘cheap’) cars. He clearly sees the flow of buyers drying up and needs to reorient the business to large, low-volume, high margin vehicles.

Many of those vehicles will be plug-in hybrids and EVs – although liquid petroleum will still be hard to beat at almost any price. The critical point is that these exceptional, high-tech marvels will NOT allow (and aren’t intended to allow) the continuance of what we earlier generations experienced as mass motoring.

The Tesla Roadster may be a wonderful car, but costs 109,000 and is basically an electrified version of the Lotus Elise which costs 40,000 – 50,000 depending on version. So you are paying 200%+ more for a car that has less range and is less versatile.

If the Tesla Roadster could have been produced for 10,000 more than the car it is based on then we might be on to something. Btw anyone know how much a new lithium pack is for the Roadster?

Great article – gives a more nuanced appraisal than most. The difference between a hangover and what we’re about to experience is this: a hangover goes away; fossil fuel depletion does not. We have to get used to an unending headache that is barely perceptible now, but which will make its presence felt more and more as the years go by.

What I am missing here is an outlook on the possibility of creating hydrocarbons directly with the surplus of renewable energy production (i.e. Substitute natural gas ).

Wind energy is efficient and wind turbines are being build at a high rate all around the world. Most of the potentially produced energy is wasted when there is wind but not enough consumers of electricity. Basically wind turbines are switched off 50% off the time they could produce energy. This energy can be used to electrolytically produce hydrogen in a first and methane in a second process. In germany Greenpeace Energy has build the first substitute natural gas plant. See http://www.solar-fuel.net/ .

The effectveness given is 60%, but as the energy would otherwise simply be lost its a huge amount of energy that can be stored and processed to a more valuable product.

Many cars in europe allready run on natural gas and the storage capacity and pipeline infrastructure ist allready there. It is a clean and easy to handle low cost source for hydrocarbons that should be developed wherever wind turbines are build.

Especialy if one considers the environmental hazards of shale gas and the overall costs for “alternative fossile fuels” for society they could be much higher then investing into renewable energy from the start. Of cause short term profits for exxon and co. will be much higher with shale gas when they are not held responsible for the amount of damage they “wreck”.

this to me sounds as one of the mitigation path, we would have to choose now on a big Scale.

the Problem with “WindGas” is, that the Process of making Methan seems to be not nearly as eficient as a direct use of electricity. Of cource the argument, that otherwise, the Wind turbines would just be shut down is true.

But as i know, for the first step, producing H2, you loose 40% of primary energy, and for the secound step, the problem is the availibility of C02 in enough concentrated form to produce methane. So maybe an intelligent combination with Biofuels for example or other ways could ease this process, but lately, you loose about 60 to 80% of primary energy. I am not sure about these numbers, maybe someone her knows it better.

But sure its a step in the right direction..

me on myselfe i think about changing my energy company to greenpeace energy for the reason i could by windgas for heating…

According to the Energy Information Administration, US consumption of petroleum products peaked in 2007 and is now down about 2 Mbpd:

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=wrpupus2&f=4

Three comments: 1. Want to know what peak oil will feel like? It’s here. I guess we didn’t plan for it.

2.This explains the much-bruited media story that the US is now an exporter of petroleum products, and the untold story of a wave of refinery closures. It has nothing to do with any new magic extraction technology; it is just that now there are too many refineries for the domestic market.

3. One positive aspect is that the US has used oil so wastefully in the past that the decline hasn’t started to hurt yet, and it may not hurt badly for a few years yet.

So which is more likely… Will our political leaders unite to make hard choices and long-term plans, with the fossil fuel companies abandoning their billions and billions in profits? Or will we just invade another country and take their oil? We’ve already invaded Iraq, and we’re teetering on the brink of war with Iran…

Such invasions seem like a rather poor way of getting oil. I mean, we *didn’t* ‘take’ Iraq’s oil, even ignoring the bombings of pipelines and reduced production. Mostly the oil countries have been happy to sell whatever we’ll buy. At best such wars might shift profits from states to Western oil companies, but they haven’t been making a positive difference for consumers.

“War for oil” is a strong meme but any simplistic reading doesn’t seem to work in reality.

Sure, but we haven’t had a real oil crunch yet. The point is, it would be very easy for us to force Iraq to sell their oil only to us, if we were really facing a shortage. Or we could simply restrict the amount of oil being sold to “enemy” nations like China, which would free up more for us. When it gets to the point where there’s not enough fuel available at any price, and it starts to be a real restriction on the military, that’s when we’ll see the claws come out.

Iraq and the middle east is far away. It would easier to conquer/merge with Canada or Mexico or both. Call it Canamerico. They are the 2 largest exporters we get oil from.

I don’t think the US is really in the Middle East to secure oil. It is there to secure the dollar. Its military presence ensures that international transactions continue to be done in dollars, because without this the dollar is worthless. Without a US military presence what’s to stop Iran, Iraq or Saudi Arabia from selling their oil to China in return for Renminbi? I believe this is already happening between Russia and China, because there is no way the US military could position itself between those two countries!

Another fine article. There is just one important point I felt you glossed over, falling EROEI. As the EROEI approaches 1, the price grows without bound. How much oil is in the ground will be completely moot once it takes more energy to extract it than it produces. That could conceivably happen in just a couple decades.

Good point. One caveat: if liquid fuels prove extremely hard to get in other ways, I could imagine spending a greater amount of energy in the form of solar, wind, nuclear, etc. to dredge the stuff up. So EROEI < 1:1 does not always stop something dead, but diminishing EROEI in practice will likely curtail use well before reaching the 1:1 level.

I think it will be moot before 1:1. At some point the economics will take over. Look at what happened when oil hit $150 a barrel a few years back, food riots in Mexico and other places.

The modern world was built on cheap oil and cheap energy. Once energy expenses go over a certain % of income, then we start to see real issues.

Agree with Tom above, we could see other cheaper forms of energy be used to pull the last liquid fuels out of the ground even with an overall EROEI of less than 1:1, due to the advantage of liquid fuels. But this will only last for a short while because soon after this it will be more economical to convert that natural gas or electricity directly into synthetic liquid fuels, rather than pulling more goo out of the ground and processing it. This is the problem I envision Venezuela’s tar sands will face.

One clarification, those other cheaper forms of energy would still need to have an OVERALL positive net energy return. For example, if natural gas is pulled out of the ground with an EROEI of 40:1, we could either 1) use it as is (overall EROEI remains at 40:1), or 2) use it to pull Venezuelan gooey tar sand out of the ground with an EROEI of 0.5 to 1 because the liquid aspect of that product is more useful than gas (overall EROEI then drops to 20:1), or 3) convert the nat gas to synthetic oil via Fischer-Tropsch at 0.5 to 1 (overall EROEI again drops to 20:1).

If we get to a point where the overall EROEI is still less than 1, then it doesn’t matter what we do — we are hooped. It’s therefore helpful to be clear about whether we are talking about total well-to-wheels EROEI or just one portion of the energy transfer steps along the way.

As this post and the seems to focus largely on the problem of peersonal transportation I have to point out, that 17% of the US oil consumption is needed in food production. Famine might be a problem even the developed countries might have to face if no new strategies for food production are sought out.

“Conventional” food production in the USA is a highly energy wasting industry. it is utterly dependable of the products of chemical giants like monsanto or bayer whos products are produced from fossile hydrocarbons. 1% of world energy consumption is used for the Haber Process for ammonia production allone.

There is a huge potential in reducing the dependency from oil if the USA would embrace sustainable agriculture. Sustainable agriculture has come a long way in the recent years an its harvest can compete with industrial agriculture.

I do not share the hope of the blog author that the energy crisis will be mastered without a huge cost of human lifes, but I have hopes for sustainable food production being able to sustain much more people than we would think.

Actually the USA might look towards the high crop harvests the amish are able to produce (largely) without the help of fossile fuel. More scientifically inclined might look into the progress german ecological farming as studied by the Technische Universität München Weihenstephan (http://www.synbreed.tum.de/) who show spectacular harvest results with advanced sustainable technologies.

See an earlier comment, suggesting renewable ammonia and electricity costs that would just throw us back to the 1950s.

https://dothemath.ucsd.edu/2012/02/the-alternative-energy-matrix/#comment-3469

In 1958 about 40% of the average household expenditures went to food purchase in Norway. In 2009 it sat a bit above 10%. This is not a trivial matter! (source ssb.no statisitcs norway)

I’m not sure Norway, with its high latitude and later discovery of oil, is the best touchstone here. The numbers given by what I link to are for the US, anyway.

Main point is, 1950 may be poorer than now but it’s a hella lot richer than 1850, which is what people tend to fear. Much of the world would love to rise to a 1950s US standard of living.

Don’t forget how much of US food production is driven by our protein-rich diet. US average is about twice the RDA (56g, according to Food Energy and Society, 3ed, pp67-68). Much of that protein comes from beef and pork, which inefficiently convert food input (corn, soy) into protein — a large portion of US crop production is fed to animals to produce meat. If we cut back our protein consumption somewhat, and shifted our protein sources away from beef and pork somewhat, we’d save a good fraction of the energy spent in food production. (40% of US corn goes to feed; 35% goes to ethanol; 15% is exported. About a quarter of US soy crop goes to feed animals, about half of that is poultry; 45% is exported. Sources: http://www.grains.org/corn , http://www.soystats.com/2011/Default-frames.htm)

[shortened by moderator]

You touched on this, but to me the Venezuelan oil sands are the real wildcard in the whole petroleum depletion scenario. They are much larger than Canada’s: [1200 Gbbl vs. 173 Gbbl according to Wikipedia]

“The Venezuelan Orinoco Oil Sands … are too deep to access by surface mining.”

Now, if price per barrel goes up:

1) More reserves in Canada will be available to extract at a higher price. Maybe it will never be possible to expand production enough to make a huge dent in depletion, but it will be economically possible. Economically recoverable reserves will expand there as oil prices rise for a while.

2) At some point I expect the Chinese to make a deal with Venezuela (I doubt Venezuela would touch a US concern with a 10 foot pole).

This is the wildcard I’m talking about. They have the need, the cash, the manpower, and brainpower to make a SERIOUS effort in Venezuela if they so choose. I don’t think Europe has what it takes to duplicate it.

I don’t think China has any experience with this sort of thing, but that hasn’t stopped them in the past with other technological efforts.

I just don’t know how that will turn out. It might amount to very little or they could dwarf Canadian oil sands production. We’ll see, but I think eventually they try.

In reply to point one. It doesn’t necessarily follow that increased extraction will be economically possible if oil prices rise.