[This topic also appears in Chapter 18 of the Energy and Human Ambitions on a Finite Planet (free) textbook.]

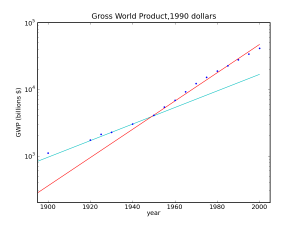

Many Do the Math posts have touched on the inevitable cessation of growth and on the challenge we will face in developing a replacement energy infrastructure once our fossil fuel inheritance is spent. The focus has been on long-term physical constraints, and not on the messy details of our response in the short-term. But our reaction to a diminishing flow of fossil fuel energy in the short-term will determine whether we transition to a sustainable but technological existence or allow ourselves to collapse. One stumbling block in particular has me worried. I call it The Energy Trap.

Many Do the Math posts have touched on the inevitable cessation of growth and on the challenge we will face in developing a replacement energy infrastructure once our fossil fuel inheritance is spent. The focus has been on long-term physical constraints, and not on the messy details of our response in the short-term. But our reaction to a diminishing flow of fossil fuel energy in the short-term will determine whether we transition to a sustainable but technological existence or allow ourselves to collapse. One stumbling block in particular has me worried. I call it The Energy Trap.

In brief, the idea is that once we enter a decline phase in fossil fuel availability—first in petroleum—our growth-based economic system will struggle to cope with a contraction of its very lifeblood. Fuel prices will skyrocket, some individuals and exporting nations will react by hoarding, and energy scarcity will quickly become the new norm. The invisible hand of the market will slap us silly demanding a new energy infrastructure based on non-fossil solutions. But here’s the rub. The construction of that shiny new infrastructure requires not just money, but…energy. And that’s the very commodity in short supply. Will we really be willing to sacrifice additional energy in the short term—effectively steepening the decline—for a long-term energy plan? It’s a trap!

Views: 43723